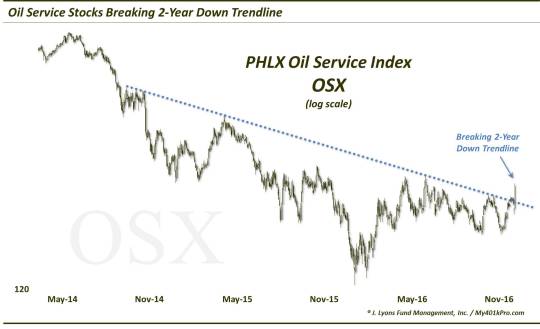

Oil Service Stocks Climb Over Key Resistance

An index of oil service stocks broke above a trendline that has held it down for the past 2 years.

Most areas of the stock market finally showed a little weakness today following the blistering post-election run-up. One area that bucked that trend, however, was oil stocks. In particular, oil service stocks climbed by 2% today, as measured by the PHLX Oil Services Index (OSX). Why were they able to resist the selling pressure? Well, the fact that oil prices were up 3% didn’t hurt. Probably the biggest factor in today’s rally in the OSX, however, was a result of what occurred yesterday. Specifically, the OSX was finally able to hurdle a key Down trendline that has held the index back for the past 2 years.

As the chart illustrates, the trendline originating in October 2014 precisely held the OSX back in October-November 2014, May 2015 and June and October of this year. Yesterday’s 9% rally in the index finally propelled it over the trendline.

So what does this mean? It means it opens up considerable upside in the OSX that had been deemed off limits by this trendline so far this year. Everyone wants to know if oil prices and oil stocks have bottomed. The action earlier this year certainly makes a good case for that. Despite that, upside in the oil services sector had been tough to come by since the initial ~50% rally from January-April. In fact, the OSX has been unable to even match its April-June highs since then…until today.

Now, those April-June highs may offer some lateral resistance to the OSX. Additionally, the 2014-2016 demolition of the sector has left considerable potholes of potential resistance. However, at least the 2-year Down trendline is no longer among that resistance. Peeling away that layer was a big step in allowing for another up-leg, finally, in oil service stocks.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.