A Huge Potential Tailwind For Bonds?

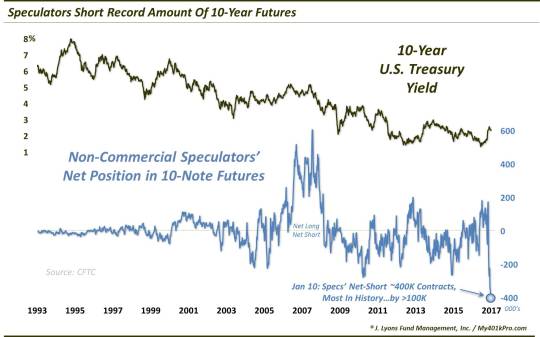

A record Speculator short position in 10-Year futures could fuel a substantial short-covering rally.

One of the most significant developments in the financial markets over the past 6 months is the potential major reversal in the bond market. After 3 and a half decades of falling yields, we may be witnessing the long-awaited bottom in the cycle. Now, obviously that is a very heady statement to make considering we may not have an answer for many, many years. And if the long-term turn higher in yields is

indeed upon us, it is still going to unfold in baby steps (last week, we pointed out what to watch for now, including a major test presently underway for the 10-Year Yield). However, the seeds of such a reversal have arguably been put into place.

One of those seeds that we pointed out last June was an overwhelming consensus of bullish sentiment towards bonds. One way this was manifested was in the positioning in 30-Year Bond futures. At the time, the “smart money” Commercial Hedgers had adopted their largest net-short position in 18 years. On the flip side, Non-Commercial Speculators, often considered the “dumb money”, were sitting on one of their longest net positions in decades. As is typically the case, that position did not work in the Speculators’ favor as bonds have spent most of the last 6 months in a free fall.

As one might imagine, the collapse in bond prices has had quite an impact on traders’ sentiment and positioning. In fact, if we shift to the 10-Year T-Note futures market, we find that Speculators have pulled a 180 and now hold their largest net-short position of all-time – by a lot. At a net-short position of nearly 400,000 contracts, it is more than 100,000 larger than any other in history.

As we have mentioned many times, the “dumb money” moniker does not mean that Speculators are always wrong. It is that they are typically are wrong at turning points and key junctures in the underlying contract. Indeed, most of the large rallies in the bond market since the financial crisis accelerated in 2008 were preceded by some of the most extreme Speculator net-short positions in the history of the 10-Year. Of course, one of the challenges in this data is identifying what constitutes an extreme. However, in our present case, I think everyone can agree that the largest Speculator net-short position in history – by a wide margin – certainly fits the “extreme” bill.

Even so, another caveat that we must always mention when discussing this CFTC Commitment Of Traders analysis is that it is not foolproof. A glance at the record net-long Speculator positioning going into the financial crisis is all the evidence one needs to conclude that. That said, their more recent history, as referenced above, has been much less successful. Therefore, we would not be banking on Speculators hitting the jackpot again.

So will this huge short position result in a massive short-squeeze induced bond rally? Only time will tell, although it is not necessarily the positioning that will spark the rally. A short-squeeze is only unleashed by rising prices. Therefore it will take a convincing bounce in bonds in order to persuade these folks to unwind their shorts. As we mentioned last week, a break below the current level in the 10-Year yield, near 2.33%, may indeed result in a sizable pop in bond prices and spur the aforementioned unwind.

Thus, this 10-Year test continues to be perhaps the most compelling development across the financial markets at this time.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.