Korean Stocks Are Breaking Out

After successfully holding key support a few months ago, South Korea’s KOSPI Index is breaking out.

Back on November 19, we posted a piece titled “Will South Korean Test Be A Red Flag For Global Markets?. The crux was that Korea’s main stock index, the KOSPI, was testing key long-term support. And given some folks’ characterization of South Korea as a global economic bellwether, we suggested that the result of the test, good or bad, may have ramifications for the global market. As it turns out, the KOSPI was successful in holding the key support and has been on an upswing ever since.

Now we are not going to try to ascribe this successful test as the overriding factor in the global sock rally since then (a certain election and trader positioning around it may have played a small role as well). However, most markets around the globe have experienced solid advances in the past 6-8 weeks. Included among them, as we mentioned, is the South Korean KOSPI. And, in fact, in the past few days the index has broken out above an important cluster of resistance near the 2050 level – and in convincing fashion.

The resistance near the 2050 area included:

- The Post-2015 Down trendline, and

- The 61.8% Fibonacci Retracement of the April-August 2015 decline

This breakout should open up considerably more upside for the KOSPI. The 78.6% Fibonacci Retracement of the April-August 2015 decline, near the 2100 level, may offer some resistance. However, with the more serious resistance near 2050 cleared, a potential path to its April 2015 highs near 2170 is not unreasonable – if the breakout is successful.

Of course, that last caveat is always “the catch”. If we’ve learned anything from global markets in the last half decade or so, it is that they’ve demonstrated a considerable proclivity for false breakouts and breakdowns. Therefore, when approaching breakouts, one should do so with a “trust but verify” attitude…or, perhaps, “don’t trust but verify”.

That said, we have witnessed more than a handful of successful breakouts over the past few months, e.g., banks, FTSE-100, etc., so perhaps that is more reason to resist dismissing this breakout.

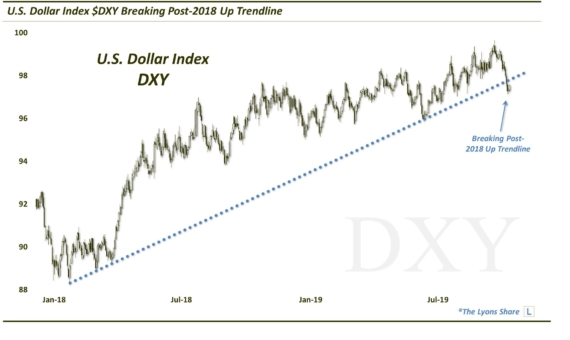

For U.S. investors, a better reason to dismiss it, as always, is the difficulty in identifying a reliable vehicle in which to exploit the move. Domestic ETF’s, like the iShares MSCI South Korea Fund (ticker, EWY), have their well-documented shortfalls, including poorly representative baskets of stocks and, most importantly, adverse currency effects. Adverse doesn’t necessarily mean the currency adjustment is working against the U.S. investor, just that it typically works against the directional bias of the local country index. And with the strong U.S. Dollar in recent years, that has meant considerable headwinds for most international equity ETF’s.

That aside, as it pertains directly to the South Korean KOSPI itself, the recent, convincing breakout should open up immediate and considerable room to the upside.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.