Can This Sector Get Moving Again? (PREMIUM-UNLOCKED)

**The following post was originally issued to TLS members on May 10, 2017. As of September 26, 2017, the trucking sector is up some 20% since, and back at all-time highs.**

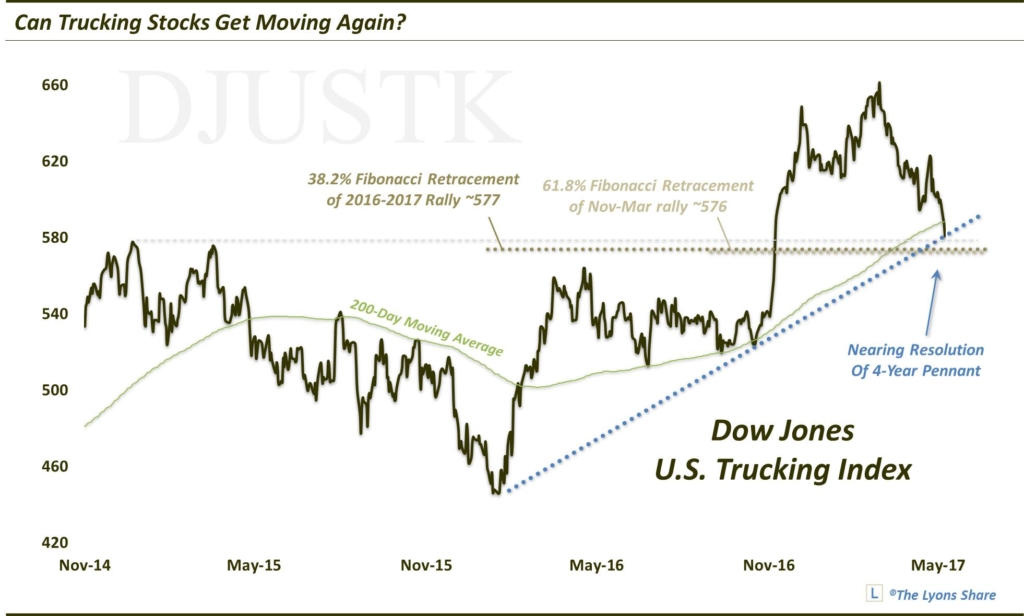

Trucking stocks have sputtered since a post-election run sent them to all-time highs; could this key chart level get the group back in gear?

One of the biggest beneficiaries of the so-called “Trump Trade” following the election was trucking stocks. Following the election, the group jumped by more than 20% in just over a month, as measured by the Dow Jones U.S. Trucking Index. That would be about all the group could muster, however. Following a slightly higher high in March, the group stalled out. A 2-month+ pullback has now brought the DJ Trucking Index down some 12% since the March high. As of today, this pullback has also brought the Index down to an impressive cluster of potential support near the 580 level. But will it be enough to jump-start the trucking stocks?

So what are these potential support legs in the vicinity of prices presently? Well, for one, if you calculated the 12% drawdown relative to the preceding 20% rally, you get an approximate 61.8% Fibonacci Retracement of the post-election rally. It is also the 38.2% Fibonacci Retracement of the rally from the January 2016 lows into this past March. You know by now how we like clusters of key Fibonacci levels.

And that’s not all of the potential support here in the ~580 range. The level also represents the former all-time highs set back in December 2014, which the DJ Trucking Index surmounted following the election. Additionally, The 200-Day Simple Moving Average and the Up Trendline from the 2016 lows, connecting the election 2016 lows, are each intersecting near this 580 level. In all, it’s a pretty compelling confluence of support here:

- 61.8% Fibonacci Retracement of the post-election rally

- 38.2% Fibonacci Retracement of the rally from the January 2016 lows into this past March.

- Former all-time highs set back in December 2014

- 200-Day Simple Moving Average

- Up Trendline from the 2016 lows

Will the support hold and get trucking stocks moving again to the upside? There is no guarantee. If this 580 area fails to hold as support, the next compelling support levels are near 550 and 525. But, again, the support layers here are compelling — enough to put our money where our mouth is. Unfortunately, there are no investable products based on this index, or any trucking index that we are aware of.

Thus, in order to exploit the opportunity, one can go a number of different routes. First off, a broad transportation fund can be utilized, e.g., the iShares Transportation ETF, symbol, IYT. Of course, the chart setup will not be identical to the Trucking Index. However, should trucking stocks pop, broad-based transportation funds should as well given the significant weighting of trucking stocks in such funds (not to mention the additional boost should Airlines stocks take off).

One can also dig down to the individual stock level for trucking plays. Again, while the single stocks will not have the same chart as the Index either, a bounce in the Trucking Index should certainly guide most trucking stocks higher as well. A couple of trucking stocks whose charts jump out at us include Landstar (ticker, LSTR), Old Dominion Freight Line (ODFL), JB Hunt Transport Services Inc (JBHT) and Marten Transport (MRTN).

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. Given the cross-currents within the stock market — and other asset classes — there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.