Is The Euro Ready For Takeoff? (PREMIUM-UNLOCKED)

The following post was originally issued to TLS members on May 17.

Recent behavior by the “smart money” in Euro futures is very interesting given the price action.

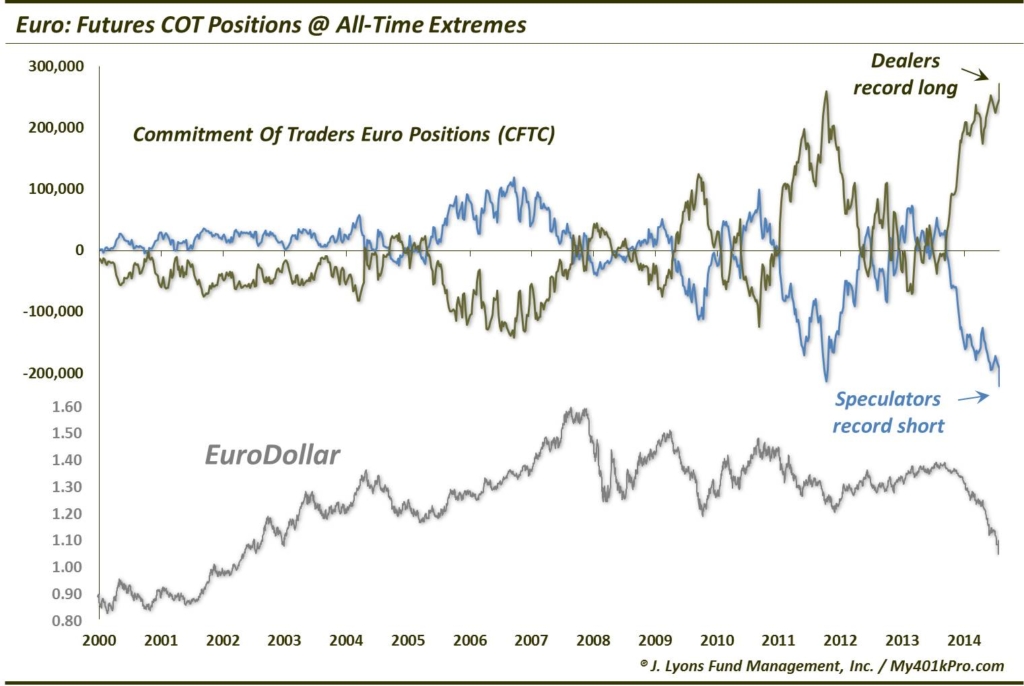

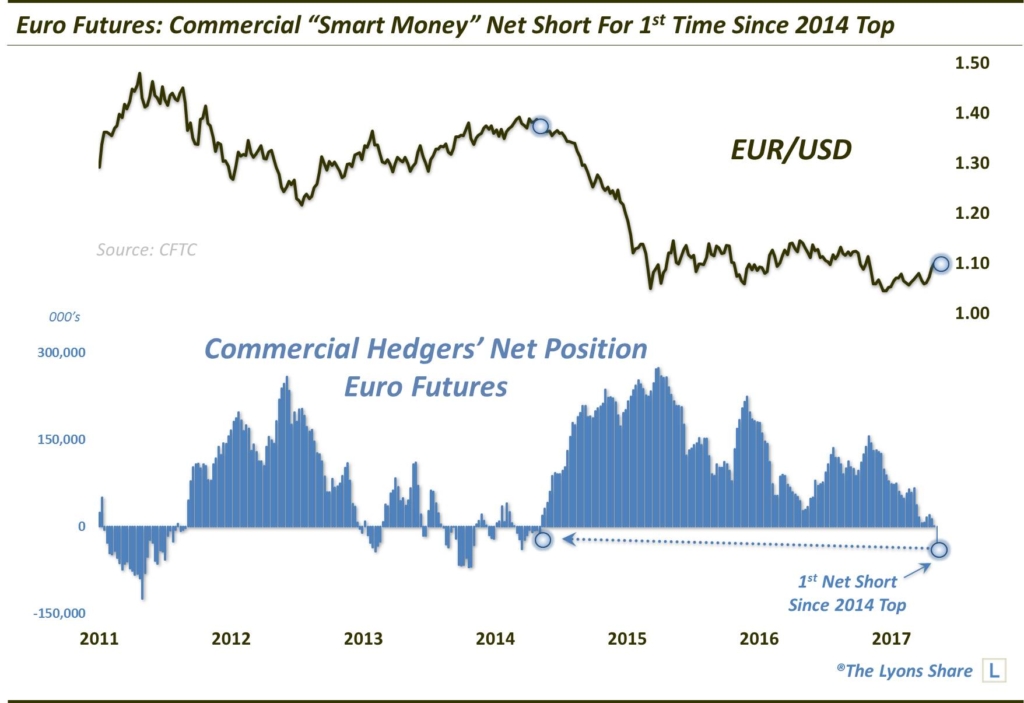

About exactly 3 years ago, the Euro was on a tear. Versus the U.S. Dollar, it was hitting multi-year highs near 1.40, having rallied some 17% over the prior 22 months. In the Euro futures market, the “smart money” Commercial Hedgers had adopted a net short position for one of the few times during the prior 3 years. Of course, these Hedgers are called “smart money” due to their proclivity for being correctly positioned at major inflection points. Sure enough, the Euro was indeed at such an inflection point. It began falling immediately and has not seen those levels since. Nor have Hedgers been net short since – until now.

Over the 12 months following that 2014 inflection point, the Euro would be sliced by 25% – a huge move by currency standards. The move obviously rewarded the Hedgers’ net short position handsomely, once again validating their “smart money” moniker. By March 2015, conditions became ripe for a bottom in the currency, as we noted in several Charts Of The Day and blog posts that month(e.g., March 4 and March 13).

One such condition was the fact that, in a reversal of their May 2014 position, the Commercial Hedgers, or “Dealers”, had actually moved to a record net long position, as our chart at the time pointed out.

This represented an enormous potential tail wind, or fuel, for the currency (via the counter-party Speculators having to unwind a record net short position), should it begin to rally. As it turns out, March 13 marked the precise low in the Euro, at just south of 1.05.

Note that I did not say that it began to rally.

Fast forward 2 years. What did the Euro do with all that potential fuel? Well, the low for the currency in March 2017 was – just south of 1.05. And the interesting thing is that, during the 2 years of the Euro going nowhere, the Commercial Hedgers have unwound their entire record net long position of 274,000 contracts. That is like burning through an entire tank of gas while driving your car on cement blocks.

And, as noted in the first paragraph, these Hedgers have actually moved to a net short position in Euro futures for the first time since that May 2014 top.

So, what do we make of this development? Well, it’s not necessarily a “sell signal” on the Euro. Remember, these futures positions can always become more extreme. And besides, although the Hedgers’ are net short for the first time in 3 years, historically speaking, the level of the net short (~33,000 contracts) is not that “extreme”.

Back in May 2007, for example, Hedgers set their largest net short position on record of more than 140,000 contracts (and far from topping out, the Euro went on to rally for another year into its 2008 all-time highs. So as we always warn about regarding this analysis — it is a tricky thing to analyze. At a minimum, we will say that the substantial tail wind that Euro bulls potentially had access to a couple of years ago is completely gone. It hasn’t necessarily turned into a head wind, but it will take more effort to rally the Euro substantially as futures positions currently stand.

That said, one thing that will always aid in catalyzing a rally is — rising prices themselves. It is especially true when prices rise above key technical levels, as the Euro has managed to accomplish in recent days. Let’s take a peek at what the Euro has accomplished, and the levels to focus on next.

First off, point #1 (April 24) was the key day for Euro bulls. Most importantly on that date, the currency was able to break above the broken Up trendline connecting the two 2015 lows. The trendline (presently near the 1.085 level) has served as an important pivot point, as it also worked as resistance following the Euro’s breakdown in the aftermath of the U.S. Presidential election. Prices were rejected at the underside of the trendline in December, February and March before breaking above on April 24. This was the key technical score for the Euro.

Also getting hurdled on that date were the following significant points:

- The 38.2% Fibonacci Retracement of the decline from the August 2015 top, the Euro’s highest since the March 2015 bottom

- The 61.8% Fibonacci Retracement of the accelerating decline following the October 2016 breakdown

- The post-May 2016 Down trendline

- The 200-Day Simple Moving Average

Today, point #2 on the chart, saw the Euro firmly clear the 500-Day Simple Moving Average for the first time since 2014. So, in the immediate-term, make no mistake, the path of least resistance in the Euro is to the upside.

How far up? 2 levels stand out. First is the ~1.12 area, occupied by the following points of potential resistance:

- The October 2016 breakdown level

- The 61.8% Fibonacci Retracement of the decline from the August 2015 top, the Euro’s highest since the March 2015 bottom

- The 23.6% Fibonacci Retracement of the decline from the 2014 top to the January 2017 bottom

Now, just because there is a cluster of resistance there doesn’t mean that prices are necessarily destined to reach it. It’s just that, if prices do reach the 112 level, they will very likely encounter some healthy resistance, at least in the short-term.

Assuming a break out above 112, the other level that stands out above there is ~117. Among the key levels in that vicinity are:

- The August 2015 Top

- The 38.2% Fibonacci Retracement of the decline from the 2014 top to the January 2017 bottom

- The 23.6% Fibonacci Retracement of the decline from the 2008 All-Time top to the January 2017 bottom

The bottom line is, the Euro has staked out key technical ground of late. The test of the broken post-2015 Up trendline has been resolved — to the upside. Therefore, the directional bias in the near-term should be up. However, a few factors may conspire to moderate the expectations for such a rally. First, a potential head wind is developing in trader positioning in Euro futures where the “smart money” Hedgers have adopted their first net short position since the 2014 Euro top. And secondly, a few potentially stiff levels of resistance sit not too far away from current prices.

Thus, the Euro may have taken off in recent weeks — but the headwind and potential price obstacles could very well add some turbulence to the ride.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.