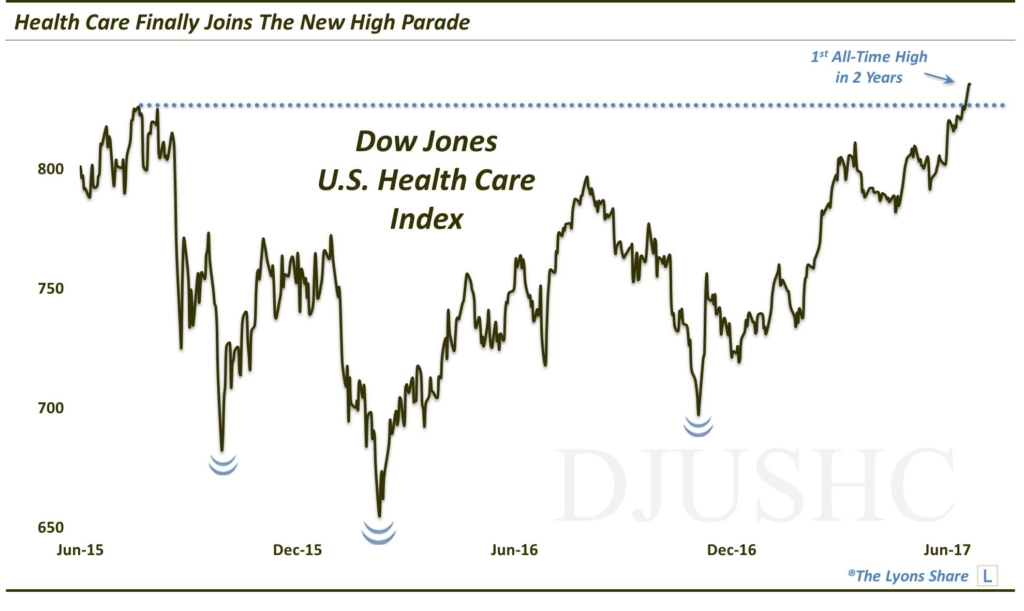

This Sector Getting Healthy Just In Time?

As other sectors stumble, health care stocks are finally hitting new all-time highs again after 2 long years

The concept of rotational leadership, in which a bull market is perpetuated by sectors alternating turns in propping the market up, is a bit overplayed, in our view. While leadership is constantly in flux — rotating, if you well — there is typically, and preferably, a healthy assortment of longer-term stalwarts leading a bull market. That said, we would concede that such rotational leadership precisely characterizes the bull market of the last 16 months — perhaps more so than any rally in recent memory.

The problem with such rotation, as opposed to broader leadership, comes when the market sectors stop rotating. That is, when the present area of leadership ceases its strength, there is less of a backup foundation of strength to support the market. Thus, unless another sector takes over the leadership mantle, the market becomes quite vulnerable.

We’re seeing just such a situation potentially unfolding over these past few weeks. With technology faltering for the first time in ages, the market is suddenly starved for new leadership. Fortunately, one sector that has been down on the mat for the past two years is finally showing some signs of life. We’re talking about the health care sector.

Health Care stocks peaked in July 2015 with the potential bubble top in biotechs, and the slightly less frothy peak in pharmaceutical stocks. Since then, it’s been a struggle for the stocks. However, since the turn of the year we seen a resurgence in the sector. This resurgence culminated yesterday with the sector finally joining most other areas of the market in achieving its first all-time high since 2015.

Now, by that we mean that most areas of the market have made new highs at some point over the past year. We don’t mean that health care stocks are presently joining them at new highs. In fact, to repeat our concern from earlier in the post, several former leadership areas, e.g., technology, have faltered somewhat of late. Therefore, the market is in need of new areas to rotate into that leadership position.

That is why this current move by health care stocks could be of great significance. If the sector, including Biotechs and Pharma stocks, is kicking off a new strong leg of the advance, it may be just the medicine this bull market needs to extend its life.

If you want the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

2 Comments