Coal Stocks About To Get The Shaft Again?

An index of coal-related stocks is hitting key long-term resistance.

Aside from banks and other stocks related to the housing market, another poster child of the last cyclical peak in stocks a decade ago was the resource space. And perhaps most notorious among that group was coal stocks.

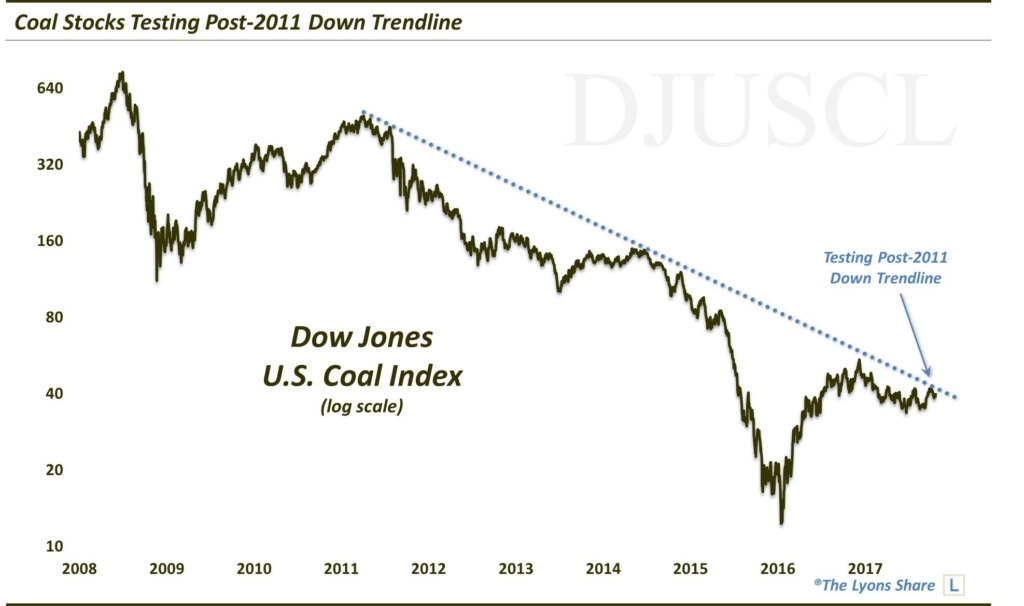

From 2002 to 2008, coal stocks, as measured by the Dow Jones U.S. Coal Index, enjoyed an epic rise, increasing roughly 20-fold. However, the old saying rang true, at least in this case, about the bigger are, the harder the fall. And from its peak near 750 in June 2008, the DJ Coal Index would proceed to lose some 85% of its value in the next 5 months alone.

After bottoming in the fall of 2008, coal stocks would rebound over the next couple of years. By April 2011, the Coal Index had recovered 61.8% (for you Fibonacci fans) of its 2008 decline. Then it was back down the shaft, so to speak. By mid-2013, coal stocks were back at their 2008 lows, and by early 2015, they were breaking down to new lows.

In January 2016, coal stocks finally found a bottom. At a low of around 11, when all was said and done, the Dow Jones U.S. Coal Index had lost a total of more than 98% from its 2008 high. Ouch. The index would recover throughout 2016, though, quintupling to 55 by December (a move that trimmed the total post-2008 loss to just 93%). It’s been back on the decline since, however.

This past June, the Coal Index had dropped to 33 before rebounding back up towards 42 this month. This 42 level may precipitate another drop down the shaft for coal stocks, though. That’s because it represents the current vicinity of a Down trendline (on a log scale) stemming from the index peak in 2011 and connecting the top in 2014.

The Coal Index has already dropped a bit from the trendline touch earlier this month. The fear is that, should the index fail to break above the trendline, another trip down the shaft may be in store for coal stocks. Of course, should the index succeed in breaking above the trendline, it would open up considerable upside for coal stocks. Who knows, it may eventually even bring that drawdown back under 90%. Either way, this trendline should be key.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. Considering what we believe will be a very difficult investment climate for perhaps years to come, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.