Special Report: Bitcoin Levels To Watch (PREMIUM-UNLOCKED)

The following post was originally issued to The Lyons Share members mid-day on December 22, 2017. See the bottom for an updated chart.

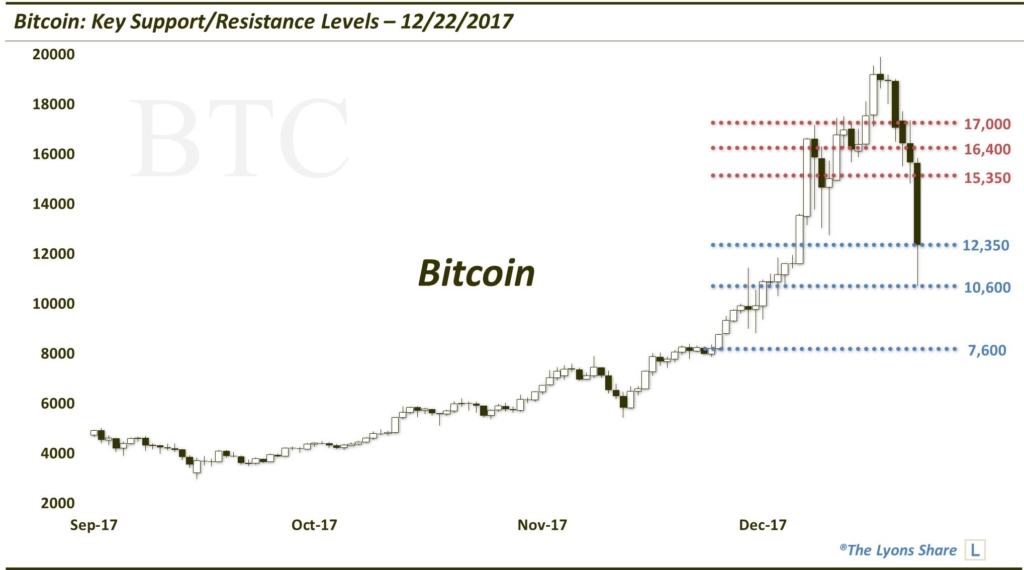

We haven’t issued a post on Bitcoin since our bullish piece in late July. Of course, the post immediately preceded the meteoric rise in the cryptocurrencey, from ~2500 at the time to nearly 20,000 in recent days. With the rout going on today, we thought we’d give our 2 cents on some possible knife-catching levels on the downside — and potential bounce targets to the upside. Obviously, this is a very fast market right now and these levels are subject to change based on price movement. We will continue to provide updates in our Daily Strategy Videos.

Potential immediate-term support levels:

- 12,350 (sitting there at the moment)

- 10,600 (spiked there this AM and held)

- 7,600

Potential immediate-term resistance levels:

- 15,350

- 16,400

- 17,000

We expect that this recent reversal puts a near-term top in Bitcoin for the time being. Some correction and consolidation is likelyin store over the next few weeks or months. We don’t have any insight as to whether this was THE top or not. That will depend on the corrective action that unfolds.

**UPDATE – December 27, 2017**

Bitcoin did bottom at 10,718 on December 22 before closing at 13,170. It has since bounced as high as 16,494 on December 27. Further updates to come as things develop.

If you’re interested in our real-time “all-access” charts and research, please check out our new service, The Lyons Share. Plus, sign up by January 1 and save 20% off an Annual Membership during our Holiday Sale. Considering the sale price, plus what we believe will be a very difficult investment climate for perhaps years to come, there has never been a better time to reap the benefits of this service. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.