Biotechs Come Back To Life

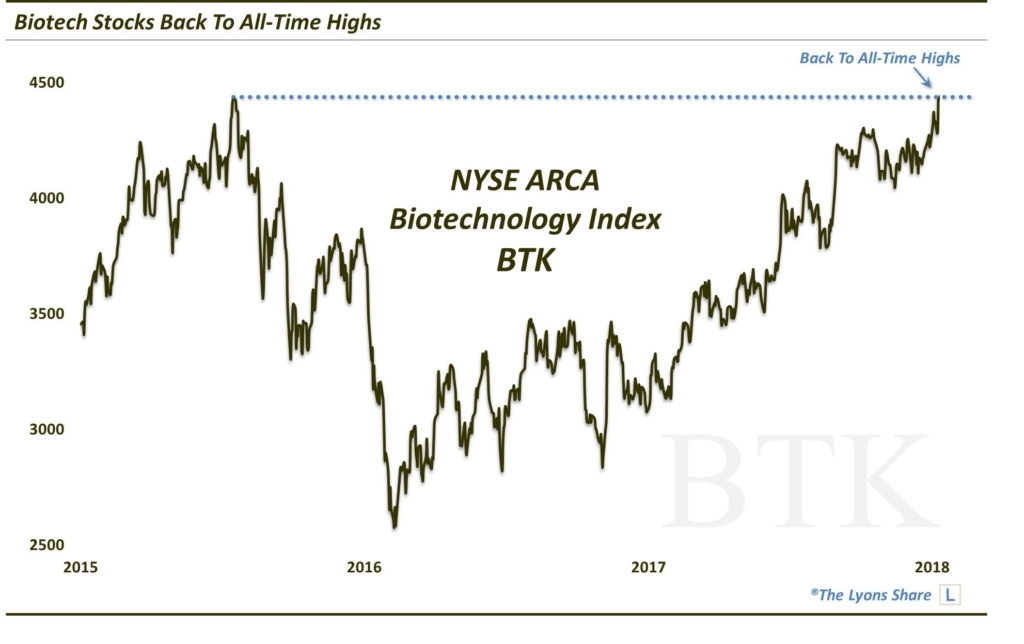

Left for dead after a bubbly blowoff in 2015, biotech stocks have finally clawed their way back to new highs.

There has certainly been no shortage of market sectors and industries contributing the stock market’s blast to new highs this past year. It almost harder to find areas that aren’t at all-time highs than those that are. Among those conspicuously absent from the new high list, however, have been a couple of health care heavyweights — biotechnology and pharmaceuticals.

Each of these prominent industries topped out back in 2015 — the biotechs in bubbly fashion, as we noted at the time. In fact, the biotech blowoff was so pronounced that we surmised the subsequent collapse spelled the demise for biotechs. However, in the present-day rotation-happy market, every dog eventually has its day, including the biotechs. As evidence, we see that yesterday — a full 18 months and 30% after the S&P 500 overtook its own 2015 top — the NYSE Biotechnology Index (BTK) finally closed at an all-time high again.

Will this new high lead to a meaningful further burst in the biotechs like the S&P 500 and other indices have experienced? It’s possible. However, ideally some form of consolidation/digestion should occur first in order to re-fuel the sector so that is has the energy to sustain a durable breakout and extension higher. That said, considering the melt-ups we’ve witnessed recently in a number of other sectors, it’s also possible that the 2015 highs serve as little more than a speedbump to biotechs as they attempt to catch up to the rest of the market.

If you are interested in the Premium version of our charts and research, check out “all-access” service, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.