Can This Consumer Staples Staple Save The Sector?

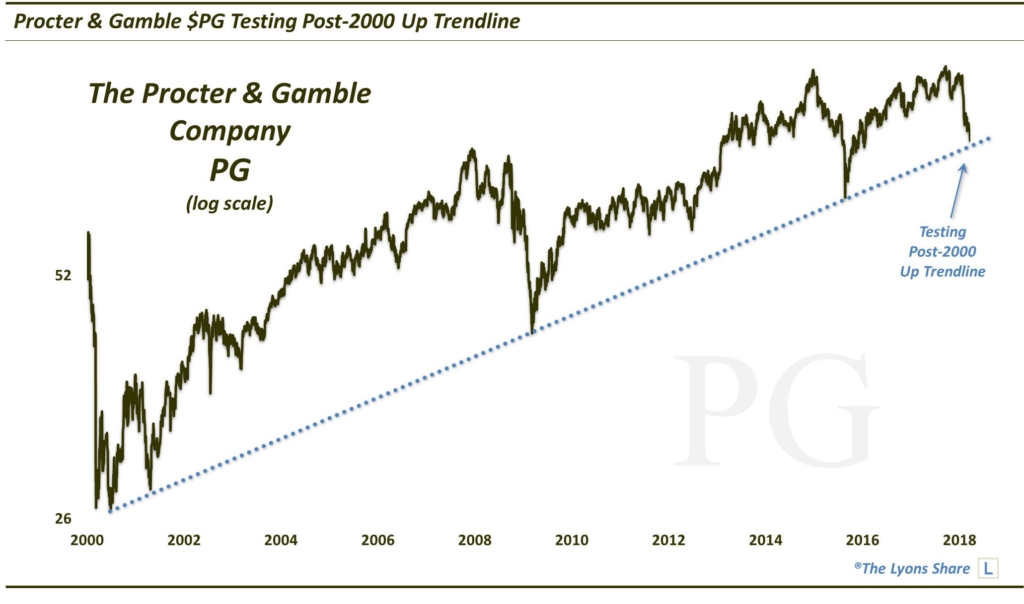

The stock of Procter and Gamble is presently testing its multi-decade trendline support.

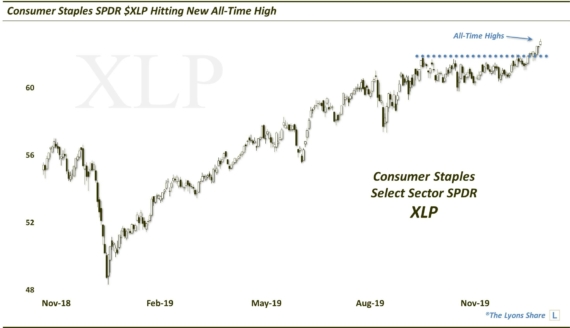

Despite the post-January stock market correction, it has been constructive to see that outside of utilities and real estate, scarcely any other sectors have broken longer-term bull market support of any significance. We noted this in a post a few weeks ago that the consumer staples sector, as represented by the Consumer Staples SPDR ETF (XLP), was testing its Up trendline stemming from its 2009 lows. After holding the trendline again, temporarily, the support has since fallen by the wayside with XLP breaking down. While definitely concerning, one key stock in the sector may have a chance to help stave off any further material weakness, at least in the near-term.

As our Chart Of The Day points out, the stock of Procter and Gamble (PG) is testing a major Up trendline stemming all the way back to its lows in 2000. This is a potentially important opportunity for the consumer staples sector in general as PG constitutes the largest weight in the XLP, at 11%.

As mentioned, if PG can hold this trendline, it may help the sector stem the tide of recent selling. That said, obviously the damage has been done on a sector basis with the XLP breaking down. Therefore, the relief may only be temporary. But it may at least be a decent trading opportunity — or a decent opportunity to ditch one’s exposure to the sector.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.