Russian For The Exits?

Recent news events sent Russian stocks plunging below key support levels — but possibly to a test of more important support levels.

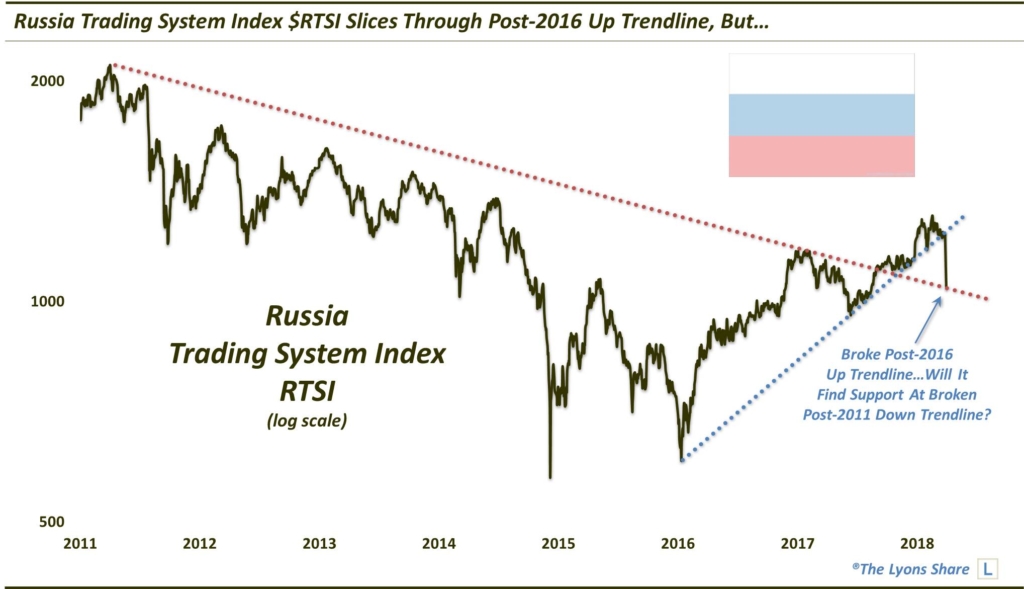

One of the more resilient equity markets during the post-January correction has been Russia. Make that had been. On Monday, following news of U.S. sanctions against the country, Russian stocks got hammered to the tune of about 10%. Needless to say, that precipitated a breakdown below key support levels that had been holding the market up, even during the recent correction. Specifically, the MICEX Composite (priced in Rubles) broke the Up trendline from its key low last June and the RTSI Index (priced in Dollars) broke the Up trendline stemming back to its 2016 lows. In sympathy, the U.S.-based VanEck Vectors Russia ETF (ticker, RSX) also broke its post-2016 Up trendline.

Before you cry in your kasha, though, Russian stocks may be finding even more important support near their lows of the past few days. Specifically, the RTSI is testing its broken Down trendline stemming back to its 2011 peak and connecting the 2017 high.

As for the RSX, it is testing its broken Down trendline stemming back to its 2008 all-time high and connecting the 2011 high.

Will these lines on a chart succeed in halting the hemorrhaging unleashed by the U.S. sanctions? It remains to be seen. It certainly won’t help Russian stocks if the U.S. President continues to call the country out in Tweets promising that missiles are coming. However, for the moment, Russian stocks have stabilized near the aforementioned levels, despite the rhetoric. In fact, the RSX is now higher by 1% on the day after opening down some 4%.

So, accounting for geopolitical risk like that which just manifested itself in Russian stocks will always be a challenge when investing in international equity markets. But having a grasp on the technical picture may assist in managing that risk — or at least help one to avoid panicking in such a scenario.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.