The Next Big Move In Commodities (PREMIUM-UNLOCKED)

The following post was originally issued to TLS members on May 4, 2018.

This obscure commodity index could well hold the key to identifying the next big directional move in commodities.

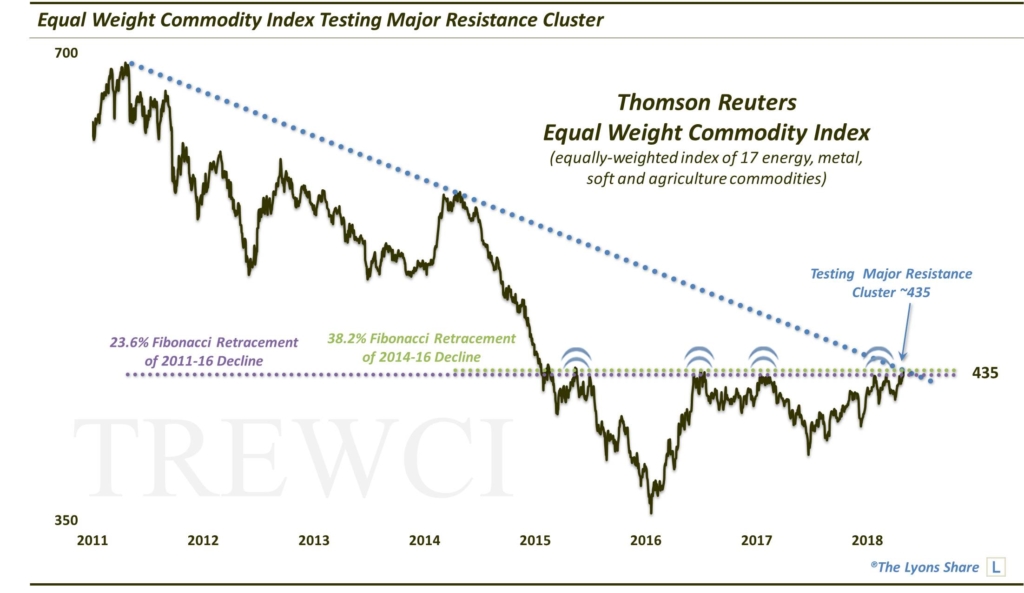

After years of languishing, commodities have had a bit of a resurgence of late — or, at least a dead-cat bounce. Using the CRB Index as a measuring stick, commodities recently broke out to 3-year highs. Of course, with oil accounting for a 23% weighting in the CRB, recent new highs may be as an undue result of a rally in oil prices. In our view, there is a better measuring stick for the overall commodity complex: the Thomson Reuters Equal Weight Commodity Index (EWCI).

The EWCI measures the performance of the following 17 commodities, on an equally-weighted basis: Cocoa, Coffee, Copper, Corn, Soybeans, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Platinum, Silver, Soy Oil, Sugar and Wheat. Thus, unlike a composite like the CRB Index, the EWCI’s fate is not unduly tied to just one or a few commodities like crude. Rather, it is more representative of the broad commodity class. And at the moment, the EWCI is at an important juncture — at which its reaction could go a long way toward determining the next big directional move in commodities.

As the chart indicates, the EWCI is bumping up against at least a trio of key potential resistance points near the 435 level:

- The Post-2011 Down Trendline

- The 23.6% Fibonacci Retracement of the 2011-2016 Decline

- The 38.2% Fibonacci Retracement of the 2014-2016 Decline

Furthermore, the EWCI has been rejected at this level roughly a half dozen times in the past 3 years. Needless to say, this level presents formidable potential resistance for the broad commodity rally. That said, here’s a little secret: sometimes when an abundance of resistance (or support) lines align at the same level, it is actually easier for prices to penetrate it. Why, probably because there is just one level to break through rather than a series of potential obstacles.

Whatever the reason, if the EWCI is able to penetrate this 435 level decisively, it opens the door to a further rise toward the mid-480’s, or about another 10%. Thus, we will be inclined to add broad commodity exposure through a broad-ranging ETP. Here are a few options: GCC, GSG, DBC or DJP. Of course, should the index fail here, or quickly fall back below following a breakout, we would stay away.

We will continue to monitor the status of this index for members in our Daily Strategy videos.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Plus, our SPRING SALE (25% OFF!!) is going on now so it’s a great time to sign up! Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.