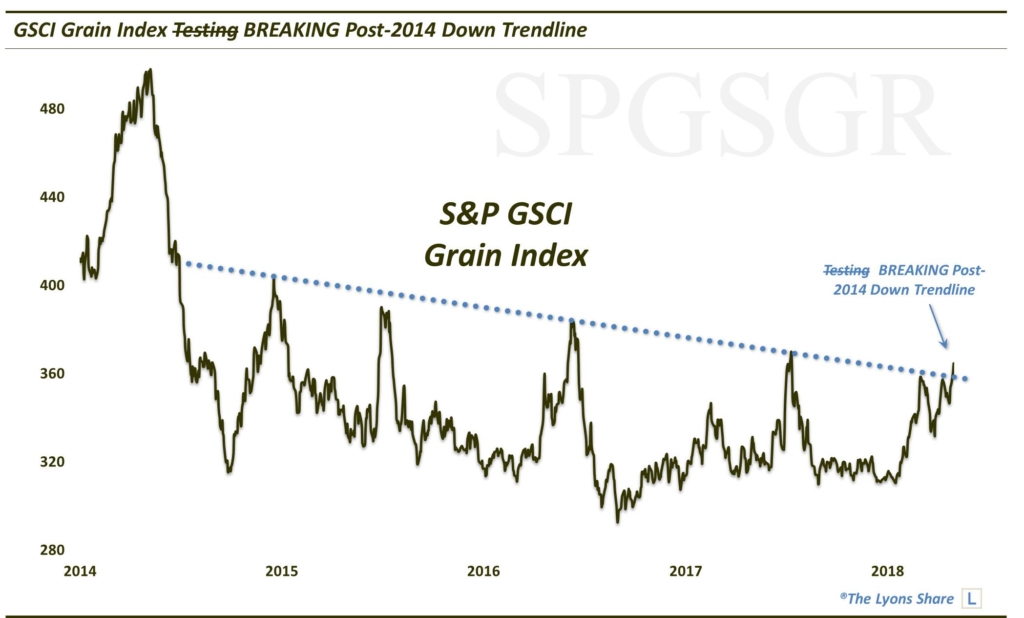

Will Grain Rally Finally Take Root?

After a decade-long “drought”, grain prices may finally be showing signs of sustaining a rally.

Since the commodity blow-off about 10 years ago, hard assets have basically been dead money. Although, there have been fits and starts along the way, that market has struggled mightily to maintain any semblance of a rally. And experiencing as much adversity as any group in the commodity complex has been the grains.

The grain market (as represented by the S&P GSCI Grain Index) actually challenged its 2008 highs back in 2012. However, it was promptly rejected, sending prices all the way down to its decade lows by 2014. Over the past 4 years, the drought in grains has been especially harsh with prices unable to budge much at all off of the lows. Yes, there have been rally attempts during that time. However, every bounce has been immediately and swiftly beaten down like a game of agricultural whack-a-mole. Until now…maybe.

Looking at a chart of the GSCI Grain Index, one can draw a trendline connecting the tops of all of the failed rallies over the past 4 years. In our #TrendlineWednesday feature today on Twitter and StockTwits, we highlighted that trendline because, for the first time in 4 years, prices are attempting to break above it.

Note how the index has already made 3 stabs at the underside of the trendline this year, with the latest attempt seeing prices inch above the line. This is in contrast to all of the failed attempts of the past 4 years when prices immediately retreated, usually giving back the entirety of their preceding gains. This is a positive sign, even if prices do not immediately follow through significantly to the upside.

Now there are reasons to be concerned about sentiment and seasonality when it comes to some of the individual grain markets. However, recent action has signaled a change in character in the grain market and may finally result in good news for long-suffering agriculture bulls.

TLS members, stay tuned to our Daily Strategy videos for more information involving grain sentiment and seasonality, as well as our strategy for taking advantage of a potential budding grain rally.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.