Strategy Note: About To Get Real? (PREMIUM-UNLOCKED)

The following post was originally issued to TLS members on December 12, 2019.

Markets continue to soar off of last week’s BTD levels — but are we buying this move?

The benefits from last week’s Buy The Dip, aka BTD, opportunity continue to accrue as the stock market further accelerates its ascent today. Whether it’s “due to” trade deal optimism or not, we don’t care — as you know. All we know is that our Risk Model as well as our technical assessment of the stock market continue to support higher prices — and a persistent strategy of buying the dips. But does that mean we are buying into today’s rally? It depends.

If you’re talking about the Dow, for example, breaking to new highs and being up some 1000 points off its low in just the past 7 days, then no. However, there are areas we’ve been stalking that are not extended — and, in fact, are pulling back to near BTD support levels. Specifically, today we are buying real estate (i.e., About To Get “Real”).

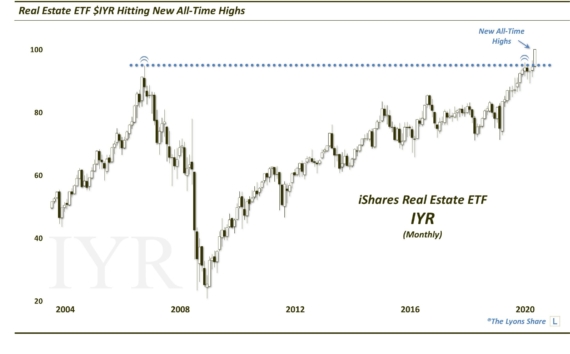

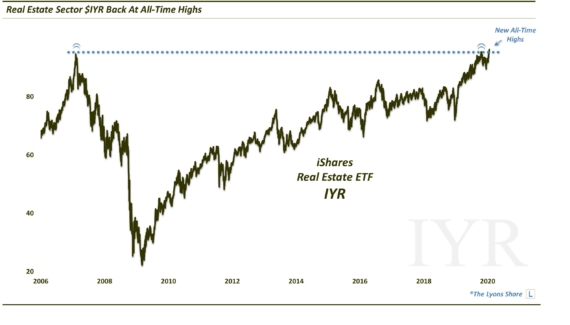

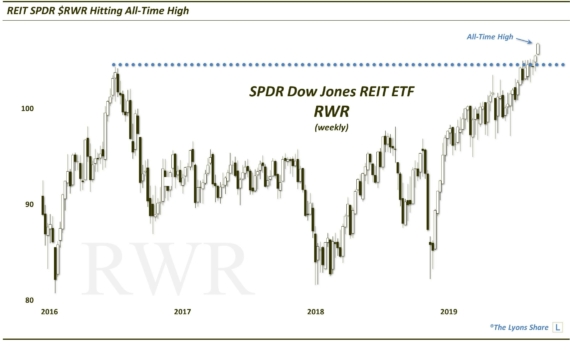

As you know, we prefer to invest in relative strength leaders, i.e., those market segments that are performing best. Real estate and REITs have been among the relative strength leaders all year. After testing prior all-time highs in October, however, we backed off somewhat to wait for better entry levels again. We’re getting those entry levels today. Specifically, we are buying the following ETF’s as they dip sharply today:

- iShares U.S. Real Estate (IYR): buying at ~90

- REIT SPDR (RWR): buying at ~101

Is it a sure thing that these “dippers” will respond as well as the funds we bought last week? There are no guarantees. But we’d rather be buying longer-term relative strength areas into dips as opposed to funds that are soaring higher. Remember, a bunch of those funds soaring today are the ones we BTD last week. Perhaps real estate will follow suit.

As always, stay tuned to the Daily Strategy Sessions for further developments.

If you’d like to see these charts as they come out in real-time, follow us on Twitter and StockTwits. And if you’re interested in the daily “all-access” version of all our charts and research, please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.