High Low Friday – 3/20/2020

Here are some of the most noteworthy highs and lows from across the markets for Friday, March 20, 2020.

These are but a few of the highs and lows resulting from another historic week in the markets.

Several categories of lows this week…some are just flat-out hitting decade or all-time lows…

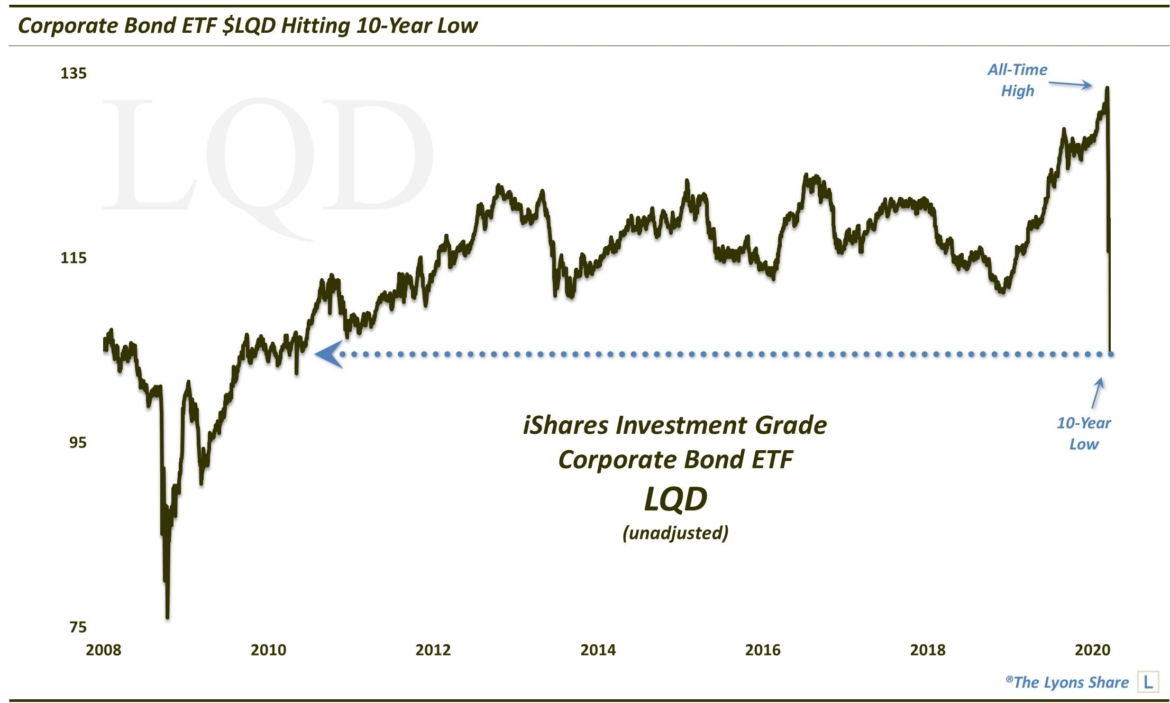

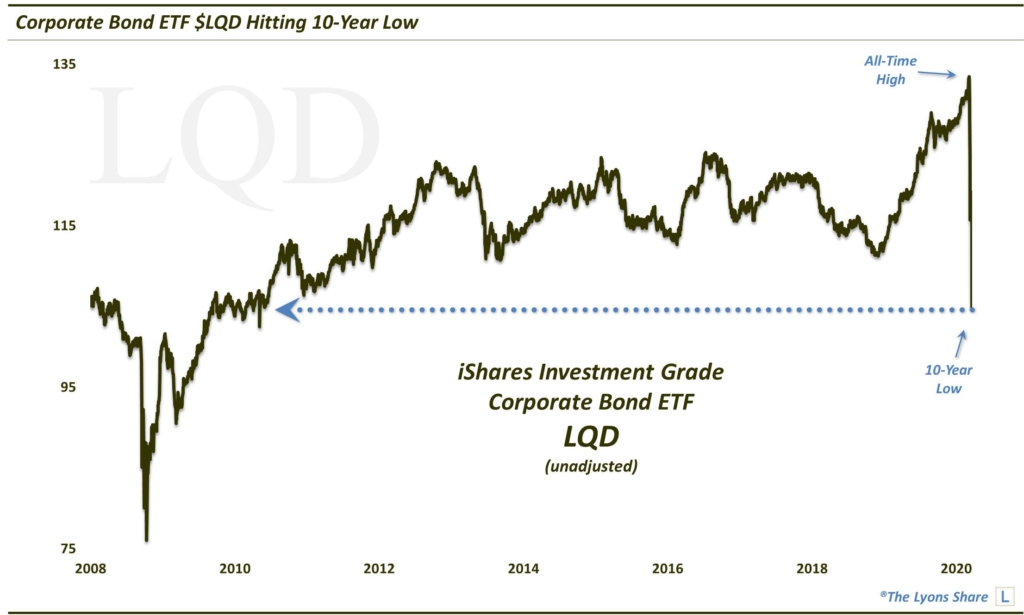

Corporate Bond ETF $LQD Hitting 10-Year Low (unadjusted)

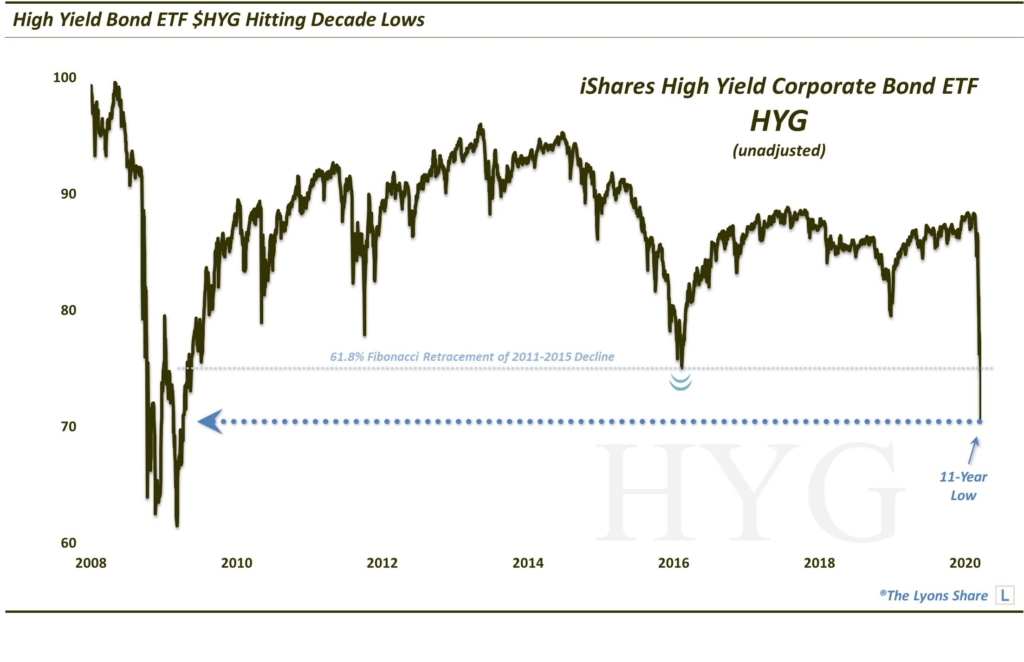

High Yield Bond ETF $HYG Hitting 11-Year Lows (unadjusted)

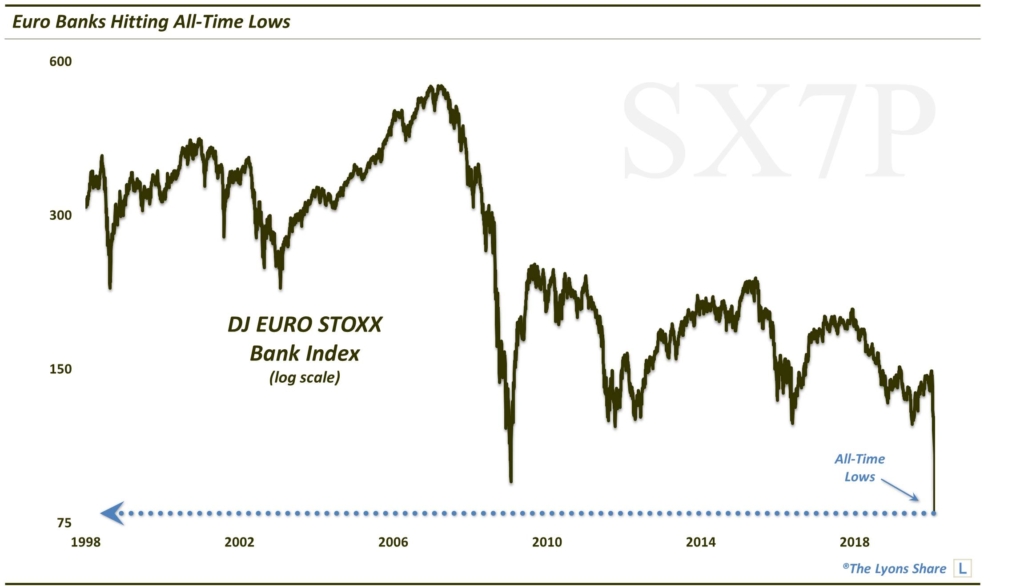

Euro Banks Hitting All-Time Lows $EUFN $SX7P

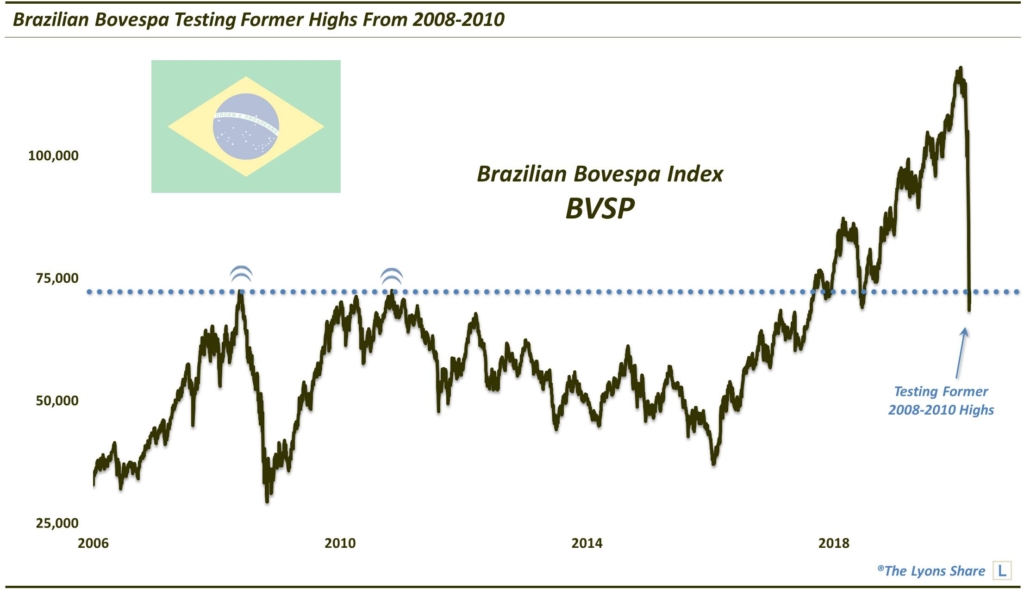

Other markets are testing former breakout highs…

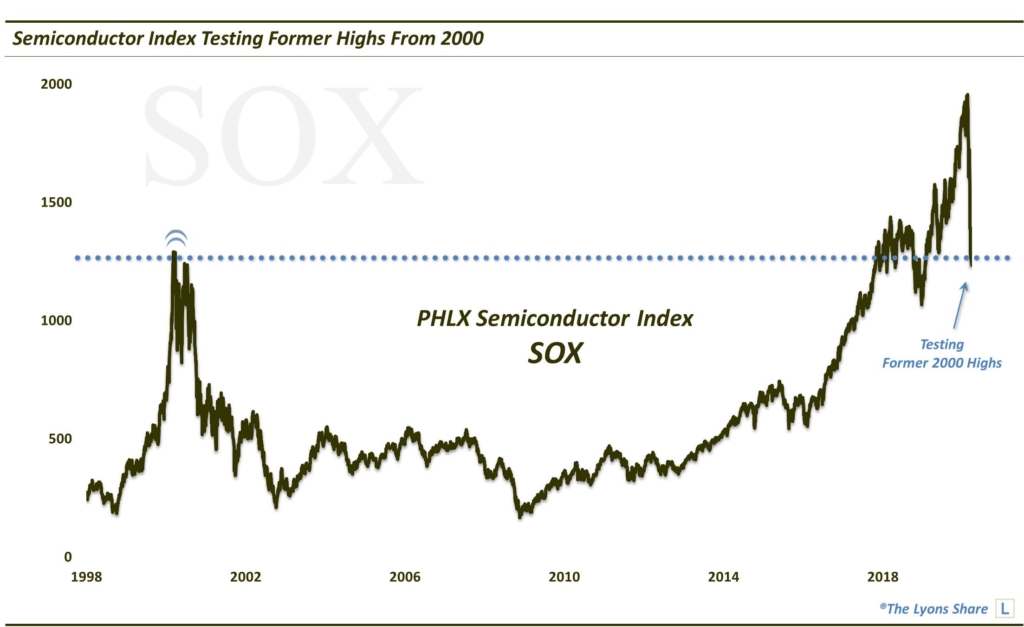

$SOX Semiconductor Index Testing Former Highs From 2000

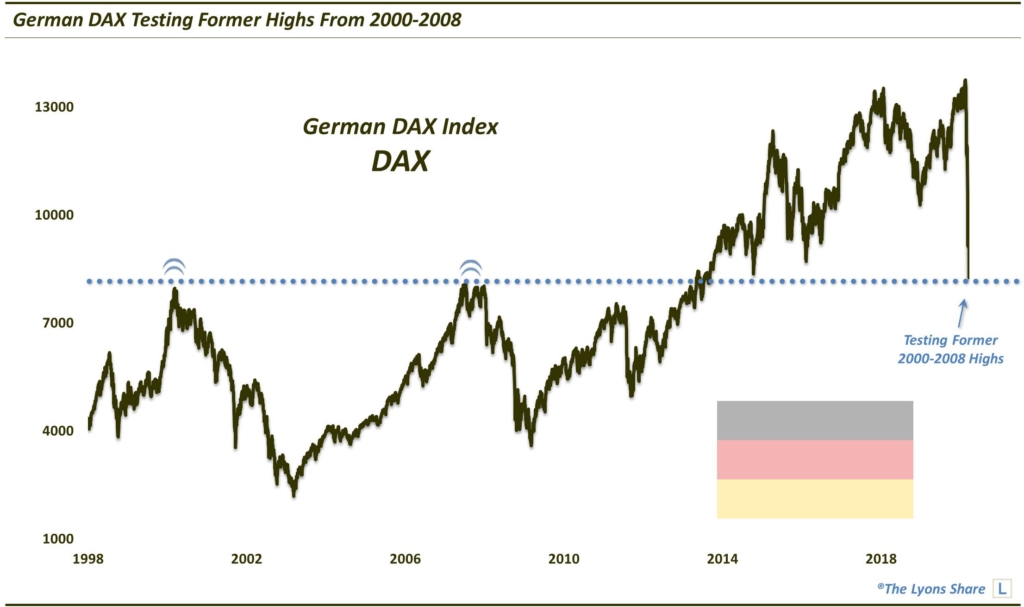

German $DAX Testing Former Highs From 2000-2008

Brazilian Bovespa Testing Former Highs From 2008-2010

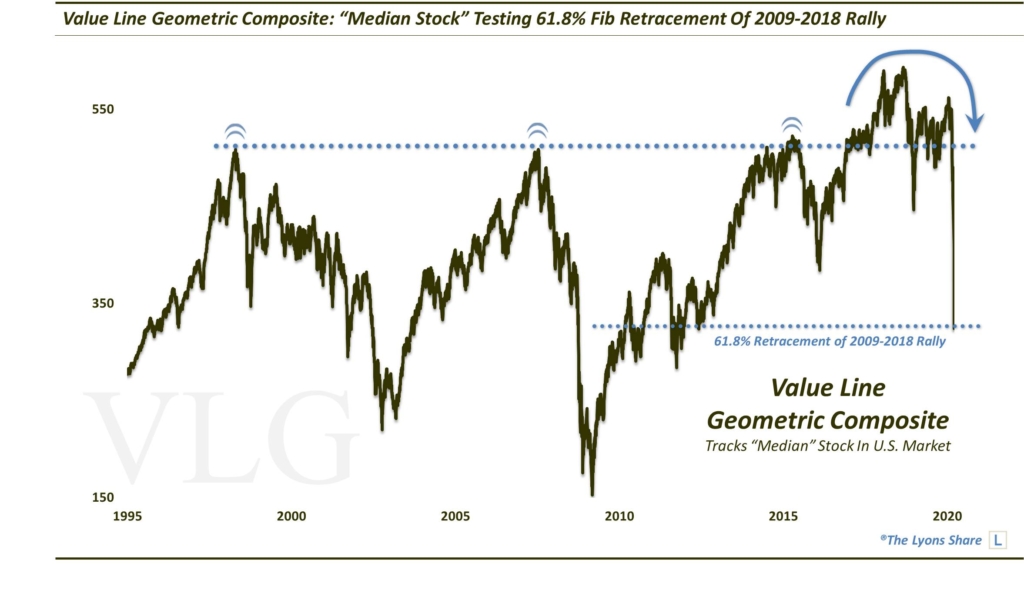

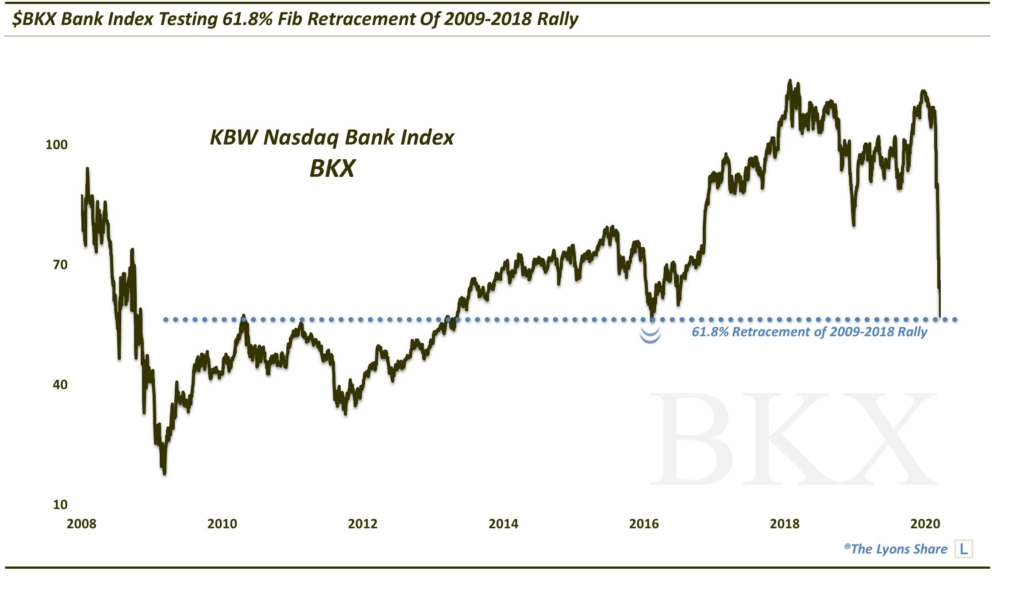

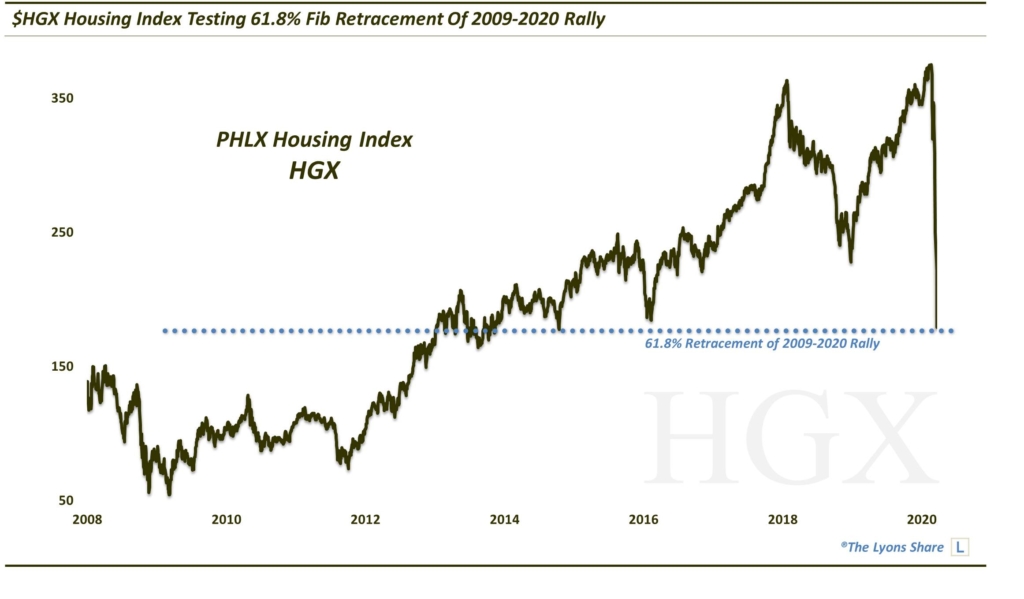

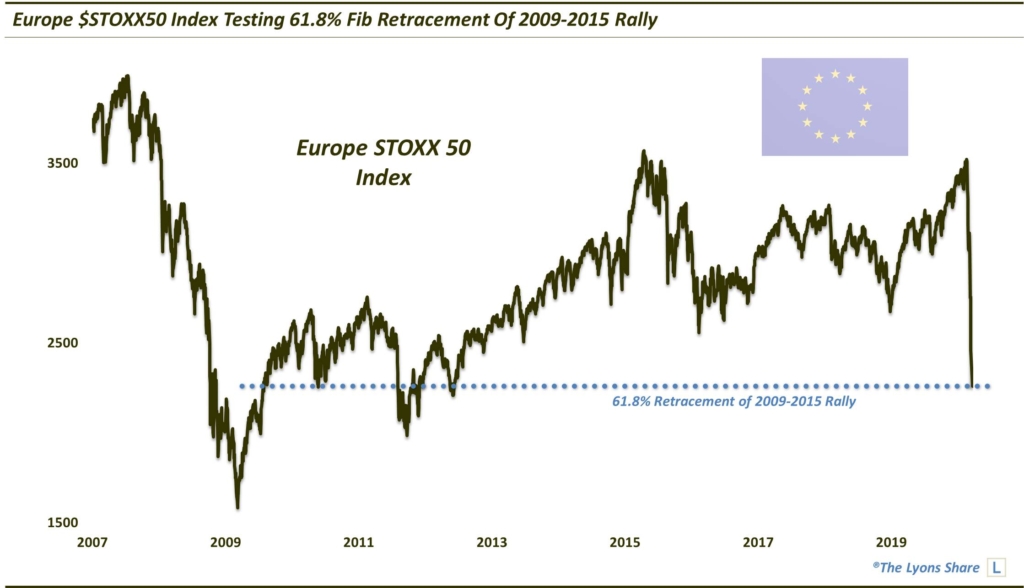

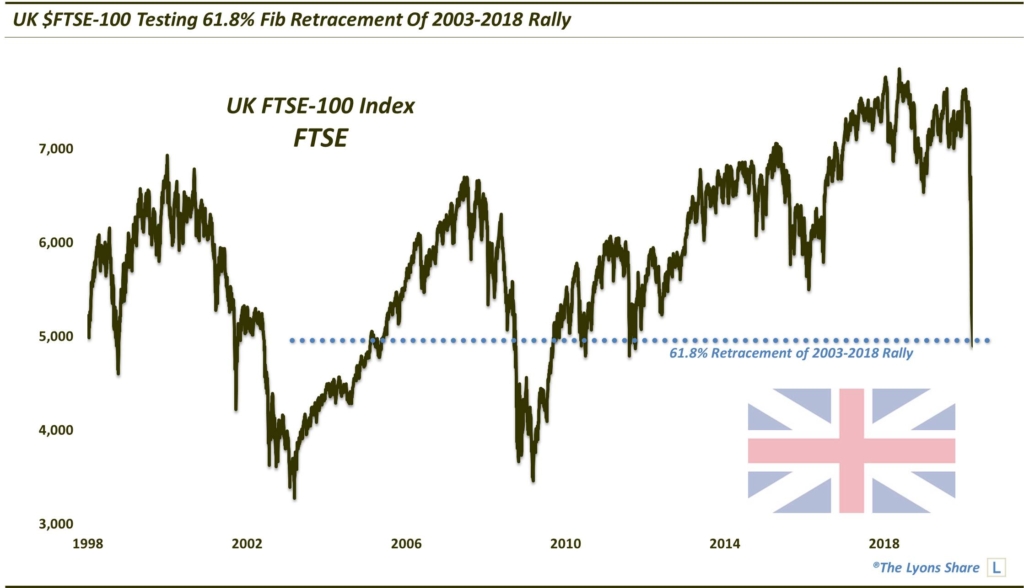

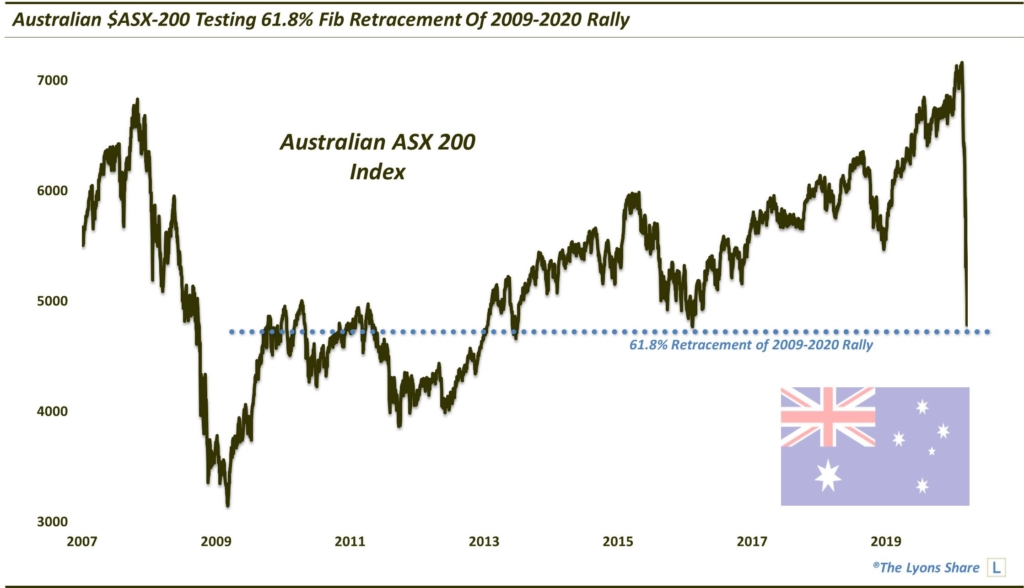

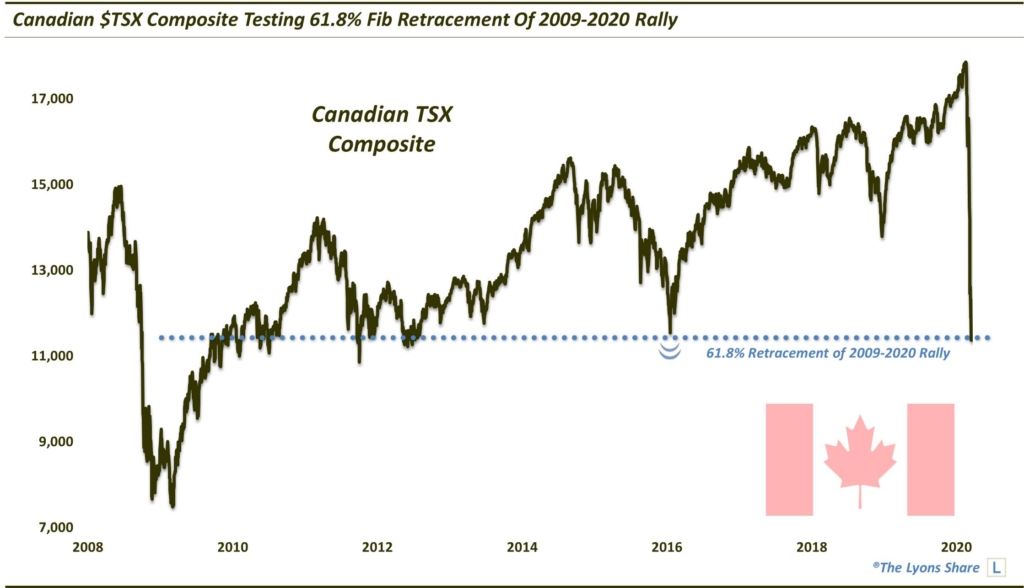

And many other markets are testing key long-term bull market Fibonacci lines (…several after trading at all-time highs just a month ago)…

Value Line Geometric Composite: “Median Stock” Testing 61.8% Fib Retracement Of 2009-2018 Rally

$BKX Bank Index Testing 61.8% Fib Retracement Of 2009-2018 Rally

$HGX Housing Index Testing 61.8% Fib Retracement Of 2009-2020 Rally

MSCI $EAFE Index Testing 61.8% Fib Retracement Of 2009-2018 Rally

Europe $STOXX50 Index Testing 61.8% Fib Retracement Of 2009-2015 Rally

UK $FTSE-100 Testing 61.8% Fib Retracement Of 2003-2018 Rally

Australian $ASX-200 Testing 61.8% Fib Retracement Of 2009-2020 Rally

Canadian $TSX Testing 61.8% Fib Retracement Of 2009-2020 Rally

If you’d like to see these charts as they come out in real-time, follow us on Twitter and StockTwits. And if you’re interested in the daily “all-access” version of all our charts and research, please check out our site, The Lyons Share. You can follow our risk-managed investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading! Due to current market volatility, The Lyons Share has set Annual Memberships at 33% OFF, indefinitely.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.