It’s About Tai-me

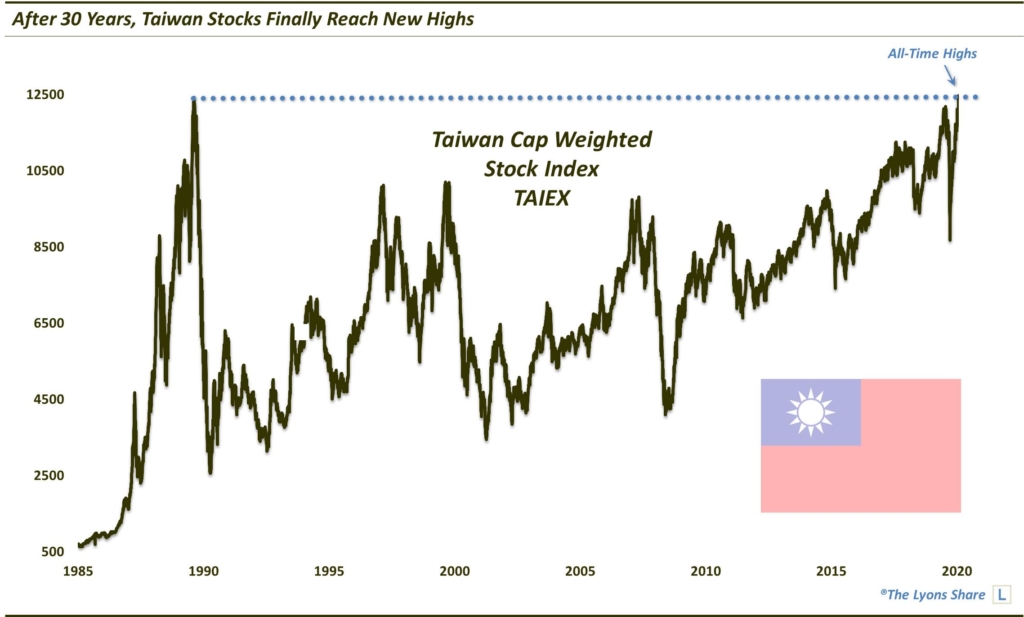

Taiwanese stocks finally make new highs after 30 years.

As our members and followers know, we monitor all types of markets in all types of asset classes in all areas around the globe. So, while some folks are obsessed with watching every tick of the S&P 500 waiting for an opportunity, we are constantly finding opportunities in some market in some area of the world. In the case of this post, it’s in Taiwan.

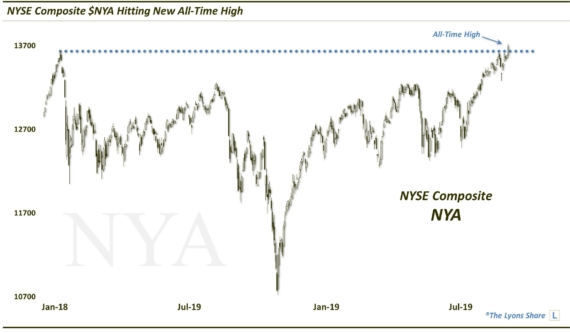

Over the past few weeks, we’ve seen a resurgence in many foreign stock markets. Included among those ranks would be Taiwan, which has clawed its way back from March’s selloff to close yesterday at a new all-time high. Now, the fact that a global equity market has made it back to new highs is impressive in itself. However, that doesn’t begin to do justice to the noteworthiness of the new high. That’s because it has been a long time coming. A really long time.

While some investors are getting anxious that the S&P 500 has been unable to yet close above its February all-time high, that’s nothing compared to Taiwan’s benchmark Taiex Index. Yesterday, the Taiex closed at a new all-time high for the first time since February 12…of 1990! That’s right — Taiwan’s stock market just hit its first all-time high in 3 decades.

So, is this an interesting bit of market trivia or is there something potentially profitable here for investors? We believe it is the latter…eventually.

How and when do we plan on taking advantage of the potential opportunity in Taiwan? Our site, The Lyons Share, provides members with an “all-access” pass to all of our charts, research — and investment moves. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.