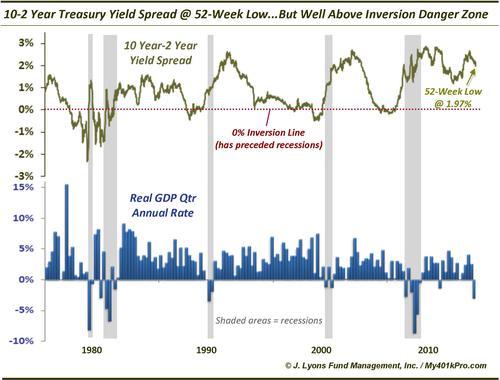

ChOTD-7/22/14 10 Year-2 Year Treasury Yield Spread @ 52-Week Low…But Well Above Inversion Danger Zone

We noticed much consternation yesterday regarding the new yearly low in the spread between 10-Year and 2-Year Treasury Yields. But while a flattening yield curve can be symptomatic of a slowing economy – or more precisely, fear of a slowing economy – historically, that has not been a reliable indicator of economic woes. That is, until it reaches inversion (i.e., 10-Year Yield is below the 2-Year Yield). Witness:

For much of the 80’s, 90’s and mid-2000’s, the yield curve was in a flattening trajectory, without much in the way of economic trouble. However, each of the recessions in the past 35 years has been preceded by an incursion by the 10-2 Yield spread into inversion territory. Even then, the lead time from inversion to recession has been at least 12 months. Thus, if a recession is headed this way, there isn’t any sign of it from this yield spread.

Of course, with the existence of “extraordinarily low rates” for an “extended period of time”, inversion would be quite the feat in this era. Is that condition causing things to be “different this time”? We are “extraordinarily” loathe to accept those 3 words, ever. However, for a ‘transitory" period of time, just about everything seems different this time.

We are out of Fed buzzwords.