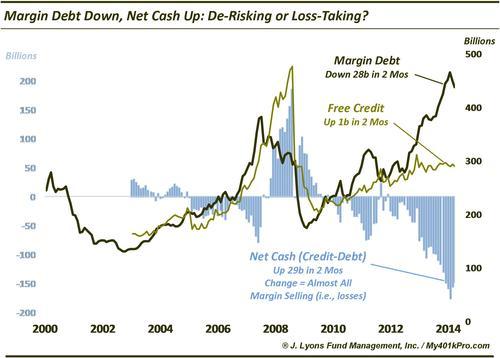

ChOTD–5/21/14 NYSE Margin Debt Down, Net Cash Up: Preemptive De-Risking or Loss-Taking?

We’ve been documenting the record rise in NYSE margin debt for about a year now. Our inclination is that, as in 2000 and 2007, the elevated level of debt represents a substantial potential risk to the market…eventually. However, as long as the market rally continued, high and rising margin debt has posed no immediate threat – and in fact has aided the rally. Only when margin debt begins to roll over (presumably by force) would pressure be put on the market. That scenario appears to have started over the past 2 months.

The blue histogram on the chart represents the “net cash” (i.e., margin debt minus cash/credit) available in investor accounts tracked by the NYSE. After hitting a record low of -$177 billion in February due to soaring margin debt, net cash has risen by about $29B over the past 2 months. In that time, NYSE margin debt has come off by about $28B and free credit, or cash (also on chart), has risen by $1B. Thus, almost the entire rise in net cash can be attributed to the decrease in margin debt. Since there was no real offset in cash, we can assume that the drop in margin debt represents losses on the part of investors, whether forced (i.e., margin calls) or voluntary.

Why would a drop in margin debt be a concern? We’ll post on that tomorrow.