ChOTD-4/10/14 This Level Has Been Key Initial Support On Pullbacks In Sector & Subsector SPDRs

It is said that much can be gleaned from studying the nature of a pullback. This includes identifying key levels or indicators the market is “respecting” as support. For example, over the past 12 months, the S&P 500 has sliced and diced its way through its 50-day moving average on multiple occasions, i.e. showing it no respect. On the other hand, the index roughly bounced off of its 100-day moving average 4 times during that span. Identifying that trend early on was helpful in enabling one to focus on the appropriate area during subsequent pullbacks.

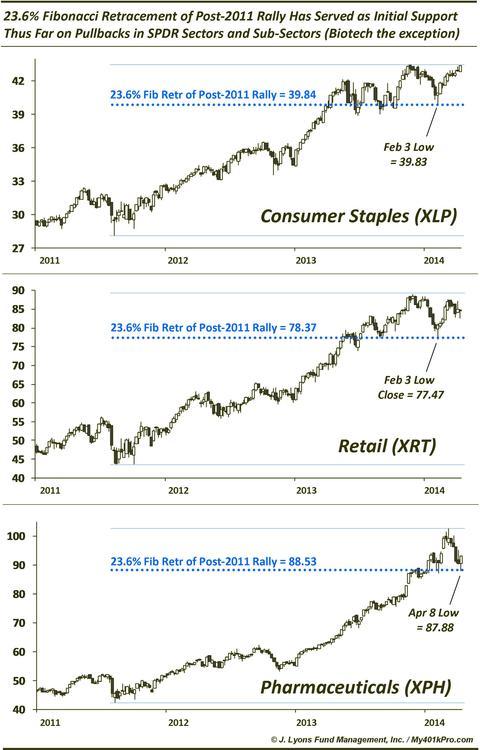

Presently, there is one area we have identified as providing key initial support thus far during pullbacks in sector and subsector SPDR ETF’s. The 23.6% Fibonacci Retracement of the rally from the 2011 lows to the recent highs has offered solid, precise support for 3 of the 4 SPDR’s that have retraced that much thus far.

Consumer Staples ($XLP) and Retail ($XRT) SPDR’s bounced 10% and 13% respectively off of their 23.6% post-2011 retracement levels. The Pharmaceutical SPDR ($XPH) bounced 6% after hitting that level on Tuesday. The only exception so far is the Biotch SPDR ($XBI) which held the level for one day before breaching it (as we posted yesterday, it is now approaching the 38.6% retracement level which corresponds with several other Fibonacci retracement levels.)

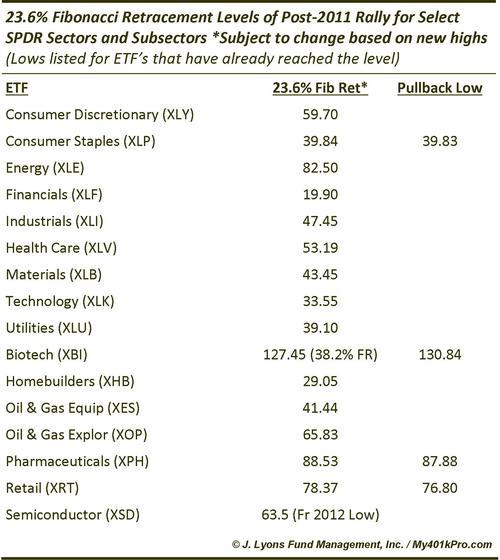

This 23.6% Fibonacci retracement level bears watching if and when other SPDR’s suffer pullbacks toward that area. This table lists the 23.6% level for the other sector and subsector SPDR’s. Traders or investors in these ETF’s may want to bookmark this post in order to monitor these developments. We will also try to provide updates as issues approach these levels.