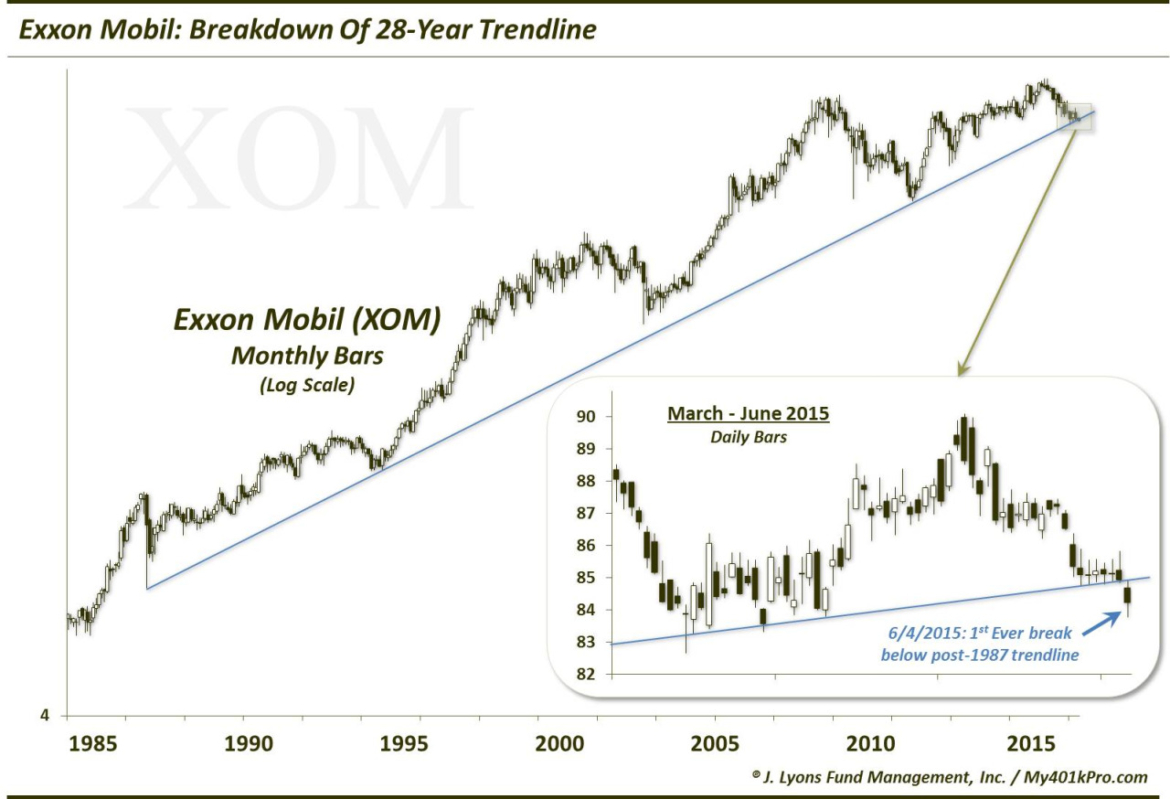

Update: World’s 2nd Biggest Stock Breaking 28-Year Trendline

On March 24, we posted a rare piece on an individual stock. As we do not invest in individual stocks, they are typically not our focus. Therefore, it takes extraordinary circumstances to inspire a post on a single stock. That was the case with the March 24 post which noted the fact that Exxon Mobil (XOM), the world’s 2nd biggest stock, was testing a trendline that began back in 1987.

The origin of the trendline, based on a logarithmic scale of XOM, is the low point of the October 1987 crash. It then precisely connects the 1994 and 2010 lows. Interestingly, the stock stopped on a dime in March once it hit the vicinity of the post-1987 trendline. I say interestingly because, at the time, the stock appeared to be in no-man’s land. There were no obvious support or resistance levels in the vicinity. And yet, the stock stopped right on the trendline. It then proceeded to “walk up” the trendline for the next 18 days.

To those who dismiss the influence of technical analysis and charting techniques on the behavior of stocks as completely random, I can hardly think of a better example of counter-evidence than this. What are the odds that a stock “respecting”, or adhering to, a nearly 3 decade-old trendline is completely random – for 18 days? Furthermore, after bouncing off this trendline into May, XOM returned to it over the past few weeks. It spent 6 straight days sitting squarely (again) on the trendline…before breaking below it yesterday.

This breakdown marks the first day that Exxon Mobil has ever closed below this trendline. Now, assuming the stock’s behavior around the trendline is not completely random, and considering its capacity as the 2nd biggest stock in the equity market, the effect of this breakdown may be profound. Absent an immediate reversal back above the trendline, this loss of 28-year support would appear to open the door to more downside in the stock.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.