Is Currency Volatility Set To Explode Higher Again?

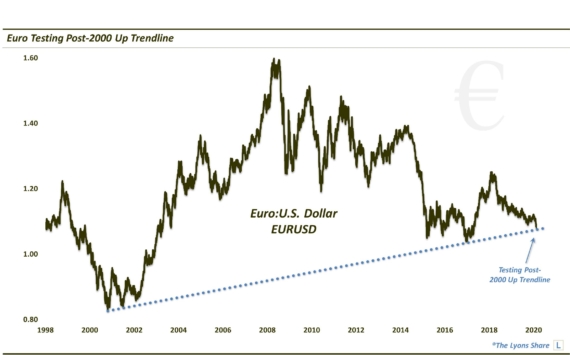

On March 13, we posted a chart noting that although the Euro currency had plunged to new lows below January levels, the Euro Volatility Index (EVZ) had not eclipsed its former high. In the past, that had been a development seen at previous lows of significance. It proved helpful again this time as the Euro bottomed that very day, rallying close to 10% over the next 2 months.

The somewhat curious thing since then, however, is that the Euro Volatility Index has not settled down to lower levels, as is common for a volatility index following a major low. Though it has not made a new high, it has hung around the previous highs of January and March while also making a series of higher lows since a sharp drop in January. The pattern it has formed through this process is one most chartists would readily identify as an ascending triangle. More times than not, this bullish formation is eventually resolved with a breakout to the upside…at least with base securities.

I say with “base securities” because many folks argue that technical analysis and charting methods cannot be applied to volatility indexes. While we would largely agree with that contention, we have observed that at least very basic charting analyses can be relevant, e.g., things like basic trendlines and horizontal support and resistance lines. So it is debatable whether or not this ascending triangle applies to the chart of the EVZ. If it is applicable, it certainly suggests that the Euro Volatility Index will eventually break out to the upside, even if temporarily. What implications would this have?

For starters, typically, when a volatility index rises, its underlying falls. Therefore, a breakout in the EVZ would suggest a decline in the Euro currency. And given the point of the March 13 post (i.e., that the EVZ would form a lower high at the bottom in the Euro) it would imply a new low in the Euro currency. This would be significant as we have suggested (most clearly in a March 4 post) that a longer-term bottoming process may be in the works for the Euro. One reason for that view is the all-time record level of speculator short position in the futures market. While this group has reaped substantial profits over the past year, it is one that is typically off-sides at major turning points.

The key, in our view, is for the Euro to move back above the 112-113 level marking the 61.8% Fibonacci Retracement of the rally from its all-time low to its all-time high. A recapturing of that level could perhaps spur a massive short-covering rally in the futures market. It attempted that feat in May but was not able to hold above that level for more than a few days. Therefore, perhaps the currency is not yet finished its bottoming process. And perhaps this ascending triangle in the EVZ is telling us that.

Furthermore, given that it is essentially the mirror image of the U.S. Dollar, it would portend bullish things for the greenback. We have also noted the all-time record long position in Dollar futures on the part of speculators. Thus, one would expect that eventually, those positions would be skewered, and badly. However, one thing the Dollar certainly has going for it is momentum. Given the epic rally of the past year in the Dollar, the odds are it is not done attempting its move higher. Such strong trends do not typically turn on a dime. Thus, perhaps a slightly higher high is not out of the question for the Dollar before any major top is in. That would certainly be consistent with a potential breakout in the EVZ and breakdown in the Euro.

Given the importance of these currencies on other markets, this potential scenario would obviously have major reverberations. While some of them are probably obvious, we can’t know exactly all of the side effects. And we can’t know the potential spark for such a scenario to unfold. But that is sometimes the beauty of charts. Accurate pattern recognition can sometimes tip one off as to subsequent economic data or developments due to the likely path of prices. If this is indeed the case in the present situation with the Euro Volatility Index, the chart suggests another burst higher in Euro currency volatility…and potentially many other markets.

________

“Rocket Chimp” photo by Chetham’s Library.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.