Bond Bulls Need To Step Up Now

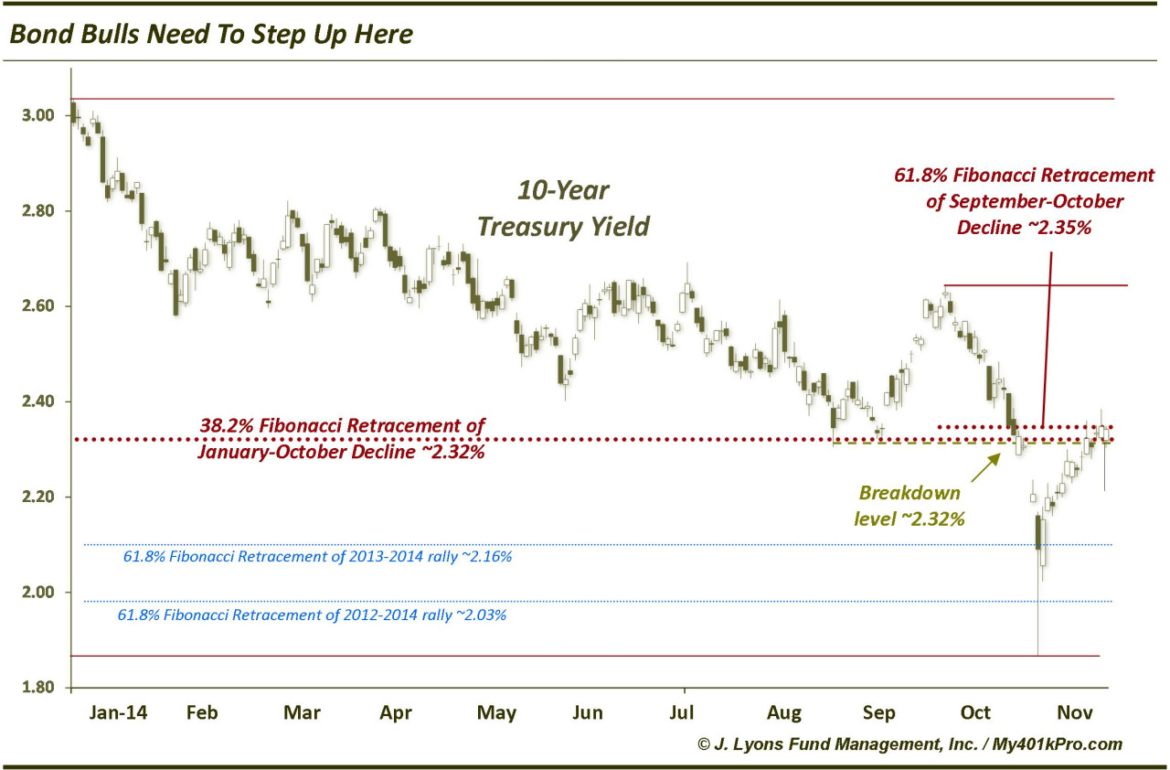

On October 14, we discussed the fact that the 10-Year Treasury Yield (TNX) was at or approaching key levels of support. It had just broken down from its previous low around 2.32% and was challenging the key 2.16%-2.18% level. A break of that level, we surmised, would open it up to an eventual drop down to 2.03%. Well, it turns out that “eventual” meant 1 day!

The TNX broke the 2.16% level the following day (as the stock market plummeted) and dropped like a rock, all the way to 1.86%. By the end of the day, however, it would recover the 2.03% area and much of its total drop, closing at 2.09%. By the following day, it had recaptured the 2.16% level.

The resulting reversal, referred to as a hammer, on the weekly chart was not something that bond bulls were too happy to see (remember, bond prices rise as yields fall.) Such hammers are considered a sign of possible exhaustion in the trend and a potential reversal on a larger scale.

There are 2 things for the bulls to take comfort in, however. First, these hammers are not always reliable. As we wrote on October 3, such hammer bars in the S&P 500 have historically led to behavior in line with any other day, i.e, no edge. Secondly, we discovered just 3 other such instances in the 30-Year Yield since 1985 in which the yield dropped more than 10% during the week only to close the week close to positive. None of those 3 marked a significant low. In fact, by 3 months later, bond yields were an average of 114 basis points lower than the reversal/hammer date.

That said, yields have continued to creep higher since the reversal, climbing to 2.35% at the moment. These levels are starting to get serious for bulls if they want yields to head back down. This nearby level between 2.32%-2.35% is significant for several reasons as it marks the:

- breakdown level of the former August and October lows

- 38.2% Fibonacci Retracement of the January-October decline

- 61.8% Fibonacci Retracement of September-October decline

Bond bulls will not want yields to climb above this spot by much or for long. If that happens, the long-awaited “rising rates” scenario has a chance at unfolding – at least in the near-term.