Is Portuguese Stock Market Finally Starting To Rebuild?

For arguably the first time in years, Portugal’s stock market has registered a positive chart development.

For much of this year, our “Trendline Wednesday” feature on Twitter and StockTwits (follow us on both at @JLyonsFundMgmt) has included examples of indices and securities testing their Down trendlines extending from their 2015 peaks. By this summer, nearly every domestic and international equity market that we track had broken up through their respective trendlines, if not exceeding their 2015 peaks altogether. One conspicuous exception is Portugal.

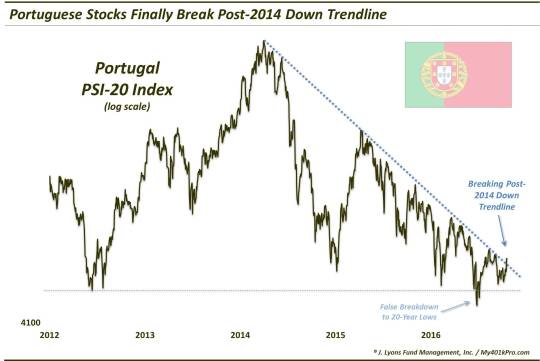

In fact, the Portuguese PSI-20 Stock Index never even made a new high in 2015. It made a post-2012 Eurozone Crisis high in 2014 near 7800 before plummeting into 2015. The best level it could reach in 2015 was roughly 6400. Therefore, the PSI-20 has not been contending with its post-2015 downtrend, but a post-2014 downtrend. And what a trendline it has been. The index has been precisely repelled by the trendline so many times over the past few years (we count about 10 touches), it would make even the most ardent technical analysis atheist say “hmmm”.

The latest touches occurred in August and September following a brief foray below the index’s 2012 lows – and 20-year lows, at that – following the Brexit affair. Contrary to our byline above, that quick reclamation of those lows was probably the 1st positive event in the PSI-20 in years. The 2nd has developed in the past 2 days as, finally, the index has broken its post-2014 Down trendline.

Now we’re not going to get carried away and label Portugal the beacon of the global equity world here. As relative strength proponents, this chart doesn’t even come close to getting us interested yet. However, when looking for deeply oversold turnaround candidates, this one would have to qualify.

The country (and its continent) obviously have major issues that have not been resolved, or even addressed, yet. Eventually, those issue will assuredly re-emerge. However, at least for now, the Portuguese stock market has begun to potentially rebuild its badly damaged technical structure…even if it is only the foundation.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.