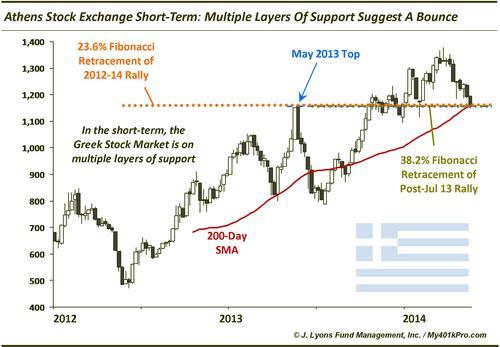

ChOTD-5/14/14 Greek Stock Market: Short-Term – @ Multiple Layers Of Support; Long-Term – Another Greek Tragedy Forthcoming?

Since emerging from the country’s riotous debt crisis in 2012, the Greek stock market has been one of the world’s outperformers for the past few years. It is typical for a severely beaten-down asset class or sector to experience such an explosive move due to the negative imbalances resulting from its rout. Since that type of rally is basically just a mean-reversion move, however, when that short-term leadership ends the asset or sector typically languishes for some time. This appears to be the case with Greece at this time. Here is a short-term (weekly) chart of the Athens Stock Exchange revealing that, while at multiple layers of short-term support, it has begun to roll over and lose its leadership mantle:

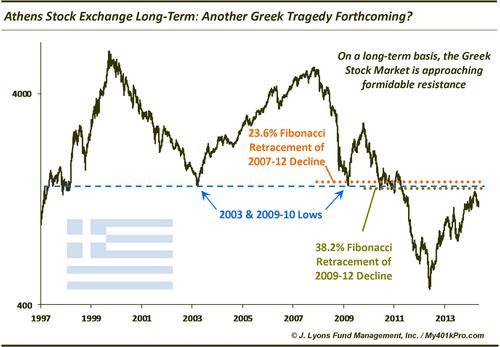

Currently it is hitting support from 1) the May 2013 top, 2) the 23.6% Fibonacci retracement from the 2012 low, 3) the 38.2% Fibonacci retracement from the July 2013 low and 4) the 200-day simple moving average. This should provide support for a near-term bounce. However, it is concerning that the Athens market has begun to make lower highs, fallen below the 50-day SMA and, most importantly, failed at a key long-term area shown here:

If Greek stocks are to make any meaningful progress from here, they will have to break through the formidable resistance posed by the previous lows formed in 2003, 2009 and 2010, as well as key Fibonacci retracement levels formed from the declines from the 2007 and 2009 tops. So while the Greek market may bounce temporarily from short-term support shown above, the longer-term challenges suggest another Greek tragedy awaits these stocks.