Trend-Setting

A vast number of markets are undergoing key tests of important Up trendlines at the moment.

If you follow us on Twitter or StockTwits, you know that we do a regular chartstorm feature called #TrendlineWednesday (though, it is often published sometime later in the week, time permitting). The feature is meant to highlight some of the more important trendlines in the financial markets that happen to be relevant at the time. It does not necessarily represent the most sophisticated of technical analysis, but it is a quick way of introducing some potentially important chart developments underway.

Today’s #TrendlineWednesday was an especially extensive one, mainly due to the fact that there is presently an abundance of important trendlines in play — all of them being Up trendlines of varying magnitude and duration. The reaction in these markets at said trendlines may go a long way toward dictating the dominant direction of equities in the near-term.

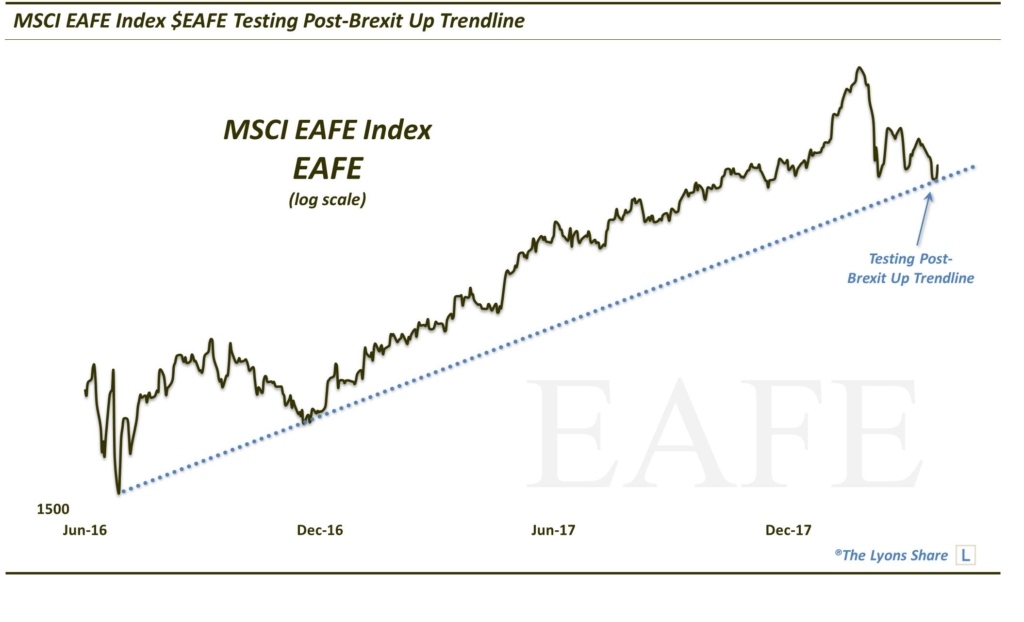

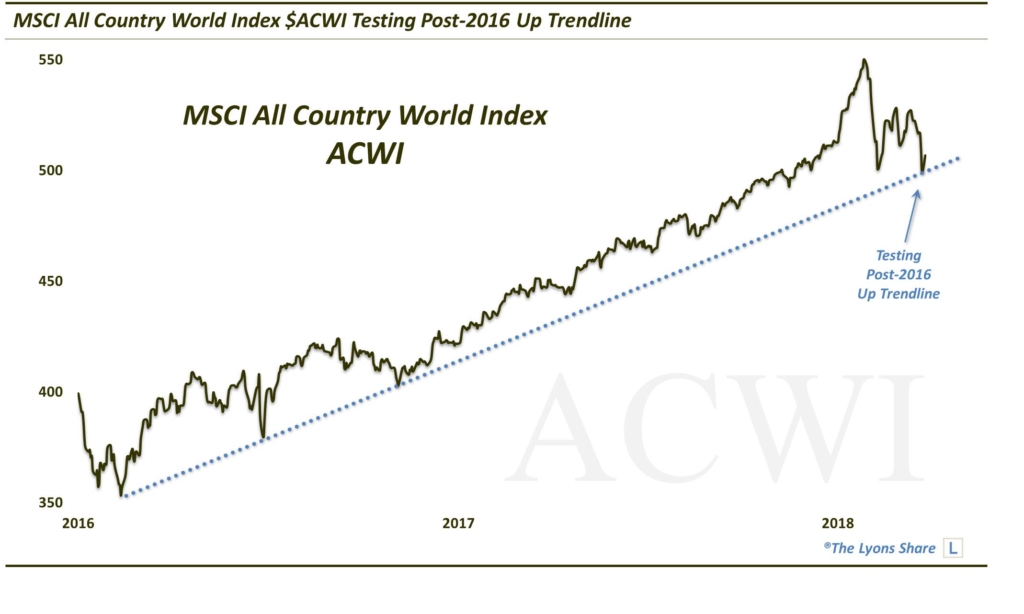

The markets presently being impacted by these trendlines include broad global indices like the MSCI EAFE and MSCI All Country World Index (ACWI)…

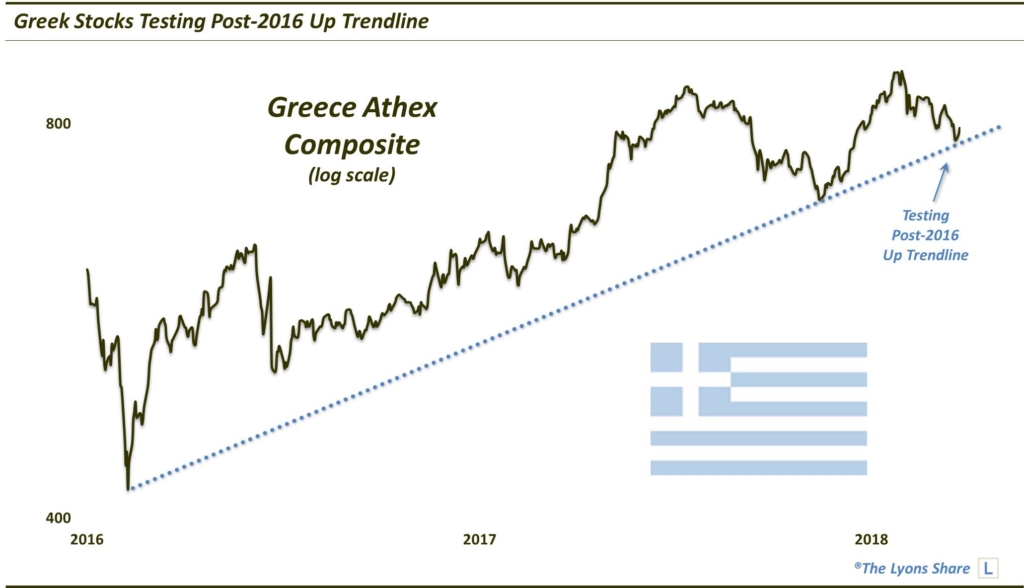

…foreign regional and country indices like the Dow Jones STOXX 600 Europe Index and Greece’s Athex Composite…

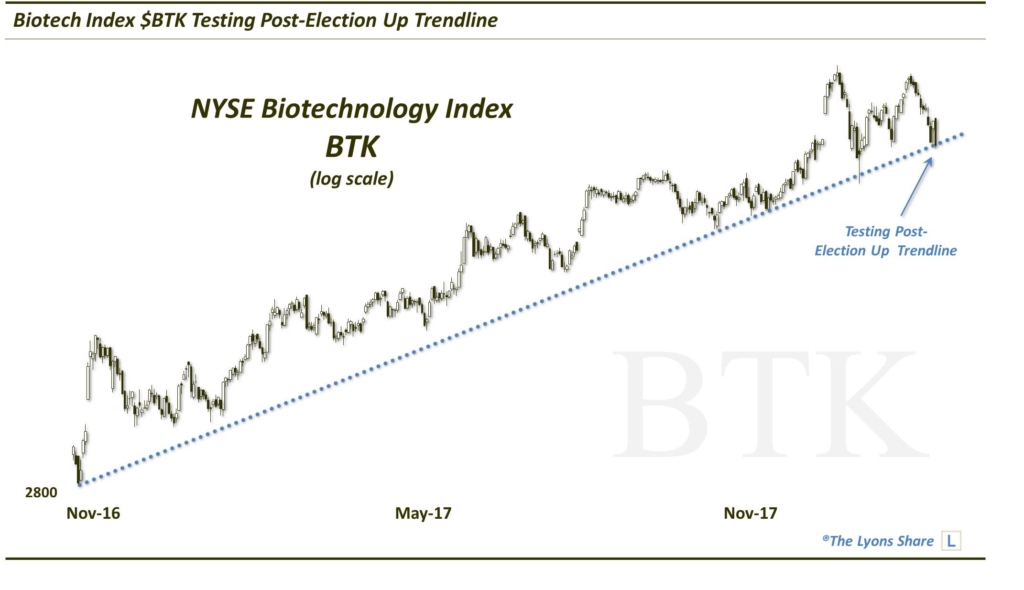

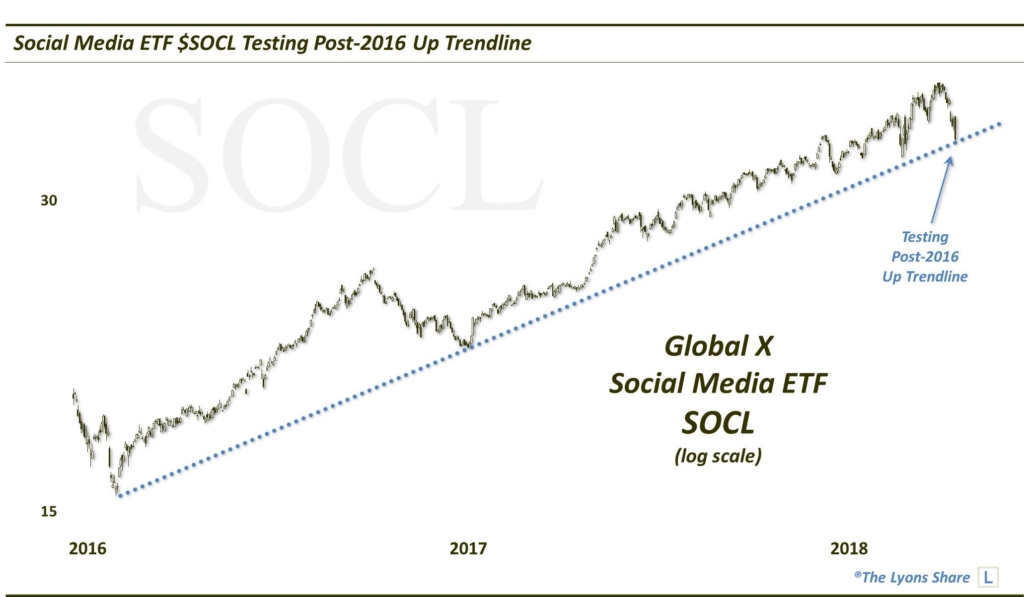

…sector-specific indices and ETF’s like the NYSE Biotechnology Index (BTK) and Global X Social Media ETF…

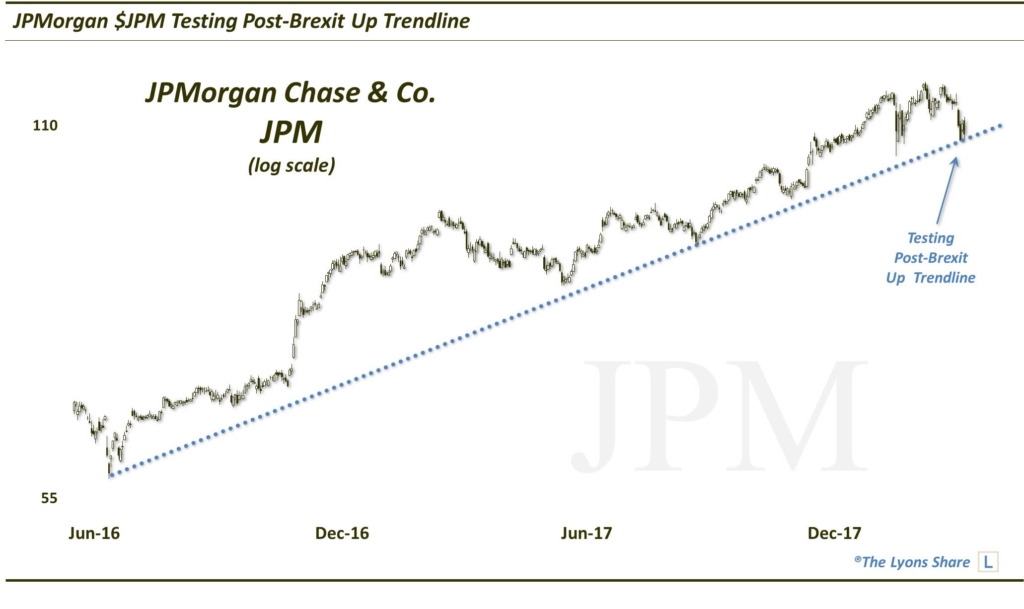

…and individual stocks like Tesla (TSLA) and JPMorgan (JPM).

The fate of the global equity bull market may not ride on these trendlines. However, the fact that so many key trendlines are in play at the present time does suggest that this is an important juncture for the market.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 Comment