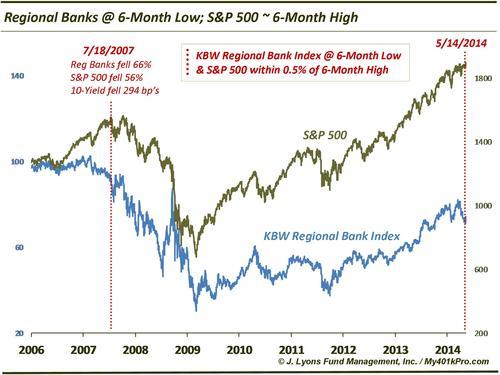

ChOTD-5/16/14 Regional Banks @ 6-Month Low While S&P 500 ~ 6-Month High

Last we looked at Regional Banks was on March 14. At the time, we noted their improving relative strength vs. the S&P 500 and the condition of rising interest rates that typically accompany such improvement. Two months later and Regional Banks make our ChOTD again – for the complete opposite reason. On Wednesday, the KBW Regional Bank Index, recorded a 6-month low on the same day that the S&P 500 closed within 0.5% of a 6-month high.

As the chart indicates, this is only the second time in the index’s brief history that this divergence has occurred. The other date was July 18, 2007 after which the equity markets immediately topped, embarking on their cyclical bear market. Incidentally, the 10-Year yield dropped essentially from 5% down to 2% during that period.

Will we see a repeat in the aftermath of the current divergence? It remains to be seen, although it is never exactly the same. However, this has to go down as yet another divergence red flag for the stock market over the intermediate-long term.