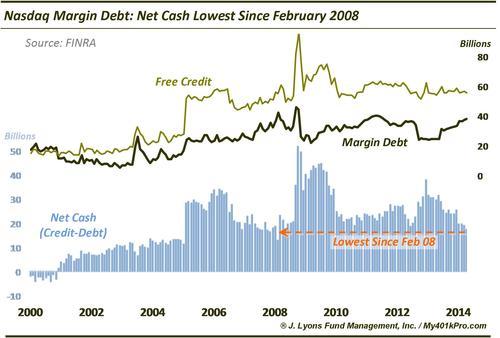

ChOTD-5/23/14 NASDAQ Margin Debt: Net Cash Lowest Since February 2008

On Wednesday and Thursday of this week, we looked at factors pertaining to the margin debt situation on the NYSE. Today’s ChOTD deals with Nasdaq (or FINRA) margin debt. While much smaller in dollar terms (about 1 tenth of the NYSE) and less prone to volatility, the current data is still interesting, particularly since we have focusing on this topic. Given the more moderate fluctuations in Nasdaq margin debt, net cash (i.e., customer account credit minus debt) gives perhaps a better read on the current makeup of the margin picture. From that perspective, like the NYSE, things do not look too constructive.

While total margin debt is below the peaks of 2007 and even 2011, when subtracting it from free credit, the net cash in customer accounts is the lowest it’s been since February 2008. Again, since this represents only a fraction of the size of the NYSE margin debt market, we are not going to go overboard in worrying about its potential negative impact on the market. Nevertheless, it is another headwind for stocks, particularly if, or when, the margin debt begins to be unwound.