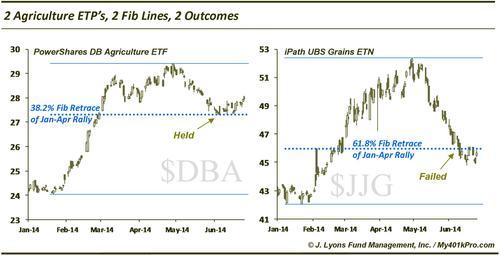

2 Ag ETP’s, 2 Fib Lines, 2 Outcomes $DBA $JJG

Last time we posted on the PowerShares DB Agriculture ETF ($DBA) on April 21, we noted it was consolidating a breakout of a short-term pennant and gearing up for a new leg higher. It did indeed break out to new highs; however, it proved short-lived. After a six week decline, $DBA reached the important 38.2% Fibonacci Retracement line of its January to April rally around 27.38, which it has held successfully, thus far. At the same time, the iPath UBS Grains ETN ($JJG) also suffered a decline, falling all the way to the crucial 61.8% Fibonacci Retracement level. It was not successful in holding this support level.

The long side of these two ETP’s obviously favors $DBA at this point, given its ability to hold its 38.2% retracement. A break of that level would be a natural stop loss area, as it would open up a move down to the low $26 area and the 61.8% retracement. (Note: it did test its 38.2% retracement of its April-June decline on the upside today at $28.12 as we alerted on StockTwits and was firmly rejected so longs are certainly not out of the woods here.)