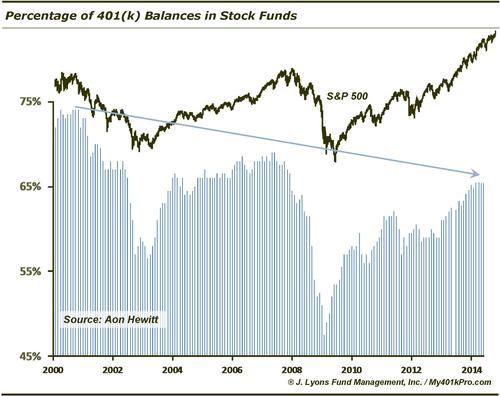

ChOTD-6/16/14 % Of 401(k) Accounts Allocated To Stock Funds: Holding @ post-09 highs, still well below 2007 highs

Following the same theme as Friday’s ChOTD on the % of Household Assets In Stocks, today we look at the % of 401(k) accounts that are allocated to stocks.

As of May, according to Aon Hewitt, 65.4% of 401(k) money was allocated to stock funds. This series has been at that general level since February.and it represents the high mark for the post-2009 bull market. As we mentioned regarding the % Household Assets in Stocks chart, this series is also exhibiting secular bear market behavior. Since 2000, although the market has generally gone sideways, and even to new highs in the current cycle, the % of 401(k) money in stock funds has made lower peaks. This is human nature on display. Many investors are still gun-shy after getting badly drilled by stocks twice in the last 14 years. Therefore, the lower peaks should be expected if we are still in a secular bear market.

One thing we can be confident in is that this % will most certainly peak coincident with a market top. When that will be is tough to discern, but perhaps there will be one last spike in the % of 401(k)’s in stock funds that will suck in the final stock market holdout.