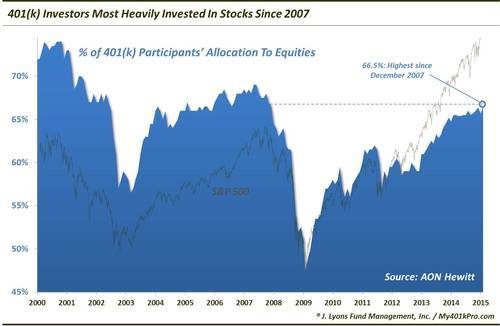

401(k) Stock Allocation Highest Since 2007

More than 7 years after the cyclical top in 2007, 401(k) investors are finally getting more comfortable with stocks again. According to Aon Hewitt, the average percentage of 401(k) accounts allocated to equities reached 66.5% in February. While still below the May/June 2007 cycle peak of 69%, this is the highest level since December of 2007.

One might say “So what? Stocks are at all-time highs so of course stock allocations are up.” That’s true. But with the S&P 500 some 40% above the 2007 (and 2000) market peak, allocations to equities are still below their highs of 2007. Why is that? We have often mentioned that the Federal Reserve’s data series showing the “% of Household Assets Invested in Stocks” (updated quarterly and released today as a matter of fact) is perhaps our favorite chart in all of finance. The series reveals a lot of information about both investment allocations as well as investor human nature.

For example, it illustrates the psychological toll that bear markets have on investors. Take the 1966-1982 secular bear market. Household assets in stocks trended downward from a peak of over 30% in the late 1960′s, even as the stock market generally moved sideways. The repeated cyclical declines within the secular bear led to more and more distrust on the part of investors. Each advance in the market resulted in lower peaks in household investment and each decline led to lower lows. By the time the secular bear ended in 1982, households had an all-time low 15% of their financial assets in the stock market.

This 401(k) stock allocation chart reveals a similar pattern taking place since 2000. While the market generally went sideways from 2000 until breaking out in 2013, the nasty cyclical declines in 2002 and 2008 led to a declining trend in 401(k) stock investment. After reaching an all-time high near 75% in 2000, subsequent peaks in stock investment have fallen well short of that level. Meanwhile the 2009 low in allocation was well below the low in 2003. Why the downtrend? Because human nature influences investors to sell near the bottom of painful declines. Thus, when markets turn back around, they have less capital invested and recover much more slowly than the stock averages. This was indeed the case with 401(k) investors over the past 15 years. According to Aon Hewitt, the biggest outflows from stock funds during that period occurred near the market lows in February 2003 and October 2008.

So is there any message now in the fact that equity allocations are now back to 2007 levels? Well, this is one study that does not lend itself to objective signals or triggers unfortunately. Rather, it likely comes down to one’s subjective interpretation – and we can see both sides to it. On the one hand, the argument can be made that, given the fact that the stock averages are well above their 2000 and 2007 peaks, current 401(k) allocations are actually low. Thus, there is more upside to both allocations and the market.

We understand that case, however, we don’t necessarily agree with it. We would refer back to what we mentioned above regarding the effect of secular bear markets on investor behavior. In such a scenario, we would expect lower peaks in stock allocations at market highs. Thus, with little room to go to the 2007 allocation peak, our feeling is that allocations are closer to the end of a cycle than the beginning of a new long-term uptrend.

“Wait, so you’re saying we’re still in a secular bear market with prices 40% higher than the prior peaks?!?!” We understand that sounds crazy to some folks. We certainly don’t dismiss the significant new highs in prices as it pertains to the secular bull/bear market debate. And we readily admit that arguing for the continuation of the post-2000 secular bear market is way out of consensus at this point. However, we have our reasons for at least considering the possibility that the secular bear market did not end in 2009. We have covered most of those reasons elsewhere but will touch on a few things to consider.

First, it is the sustainability of the new highs that will determine whether or not the secular bear market is truly over. And while it seems far-fetched that prices could decline back to the 2000-2013 range again, it is well within the realm of possibility as it would “only” take a 25% decline to get there. Secondly, the behavior of investors like that seen in the 401(k) allocation chart is still emblematic of secular bear market action. The lower highs and lows in allocation should be expected during such a scenario. And while it would also be expected to see investors slow to climb aboard a new secular bull market, there are other factors that lead us to believe that the secular bear may reawaken at some point.

One other point we will mention is that the “Household % in Stocks” series has surpassed its 2007 peak. Does this dispel our “secular bear investment behavior” thesis? We have an open mind about it, but we don’t think it does necessarily. Consider that it took Households more than a year after the market’s breakout to new highs to finally reach their 2007 peak investment in stocks. Meanwhile, stock averages are 40% higher than their previous peak. Based on that fact, household investment is still lagging far behind the market.

So why are 401(k) investors not at new highs in equity allocation as well? It’s not clear but we have our theory. For most 401(k) investors, their entire retirement savings is contained in their 401(k). They have no other real investments. Therefore, they have more to lose when it comes to the performance of their 401(k) than do other investors. And therefore, the human natural pressure on them is greater, including “fear”. This is especially relevant at bear market lows, as we indicated. Their desire to protect what they do have has forced them to bail out of stocks at the very worst times.

If nothing else, this study should serve as a message to the industry: 401(k) participants need investment help. The defined contribution system has dictated they become investment experts. That isn’t fair. And, outside of re-engineering the retirement investment system, it should be a priority for those in the industry to seek out and help these individuals.

__________

“401K” photo by 401(K) 2012.

More from Dana Lyons.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.