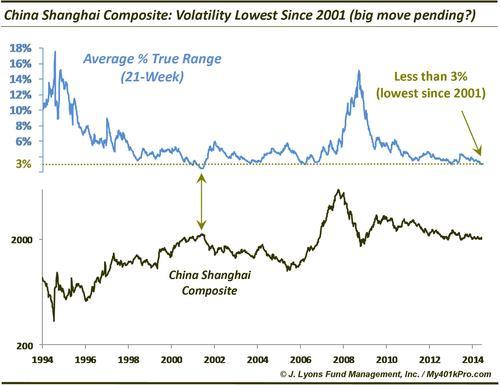

ChOTD-6/20/14 China Shanghai Composite: Volatility Lowest Since 2001 (big move pending?)

The U.S. isn’t the only country witnessing low volatility markets currently. In China, the Shanghai Composite is currently exhibiting the lowest level of volatility since 2001, as measured by its Average True Range.

Currently, the 21-period weekly ATR on the Shanghai Composite is 2.97%, meaning over the past 5 months or so, the index has moved in a range of less than 3% per week, on average. Low volatility extremes typically lead to explosions in volatility. Two notable examples from this chart are 2006 when the index commenced its parabolic move up, and 2001 (the last time the ATR was less than 3%) which led to a 4-year decline of more than 50%. Will we see the same volatility soon? That is TBD, but it would not be surprising.