ChOTD-6/26/14 CBOE SKEW:VIX Ratio: Variant Tail Risk Indicator At All-Time High

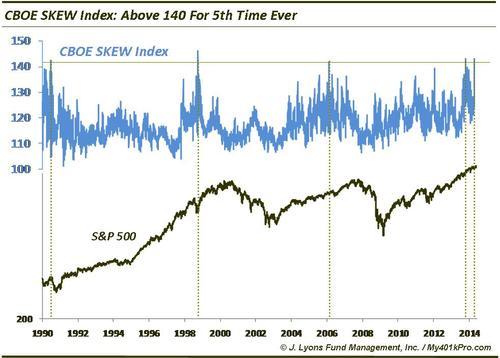

Readers may be familiar with the CBOE’s SKEW Index. Generally speaking, it is an options-derived measure of market tail risk, i.e., risk of an outlier, black swan event (more SKEW specifics at CBOE). On June 20, the SKEW Index hit 140 for just the 5th time in its history (since 1990).

The first occurrence, in 1990, took place just weeks before Saddam Hussein invaded Kuwait and prompted a significant market decline. That warning popularized the SKEW as a meaningful predictor of tail risk. Since then, however, elevated readings have been less meaningful. A March 2006 occurrence came two months before an 8% selloff in the S&P 500 and the December 2013 occurrence preceded a 6% selloff by a month – not exactly black swan events. (Other readings near the 135 level provided timely warnings in 2010, 2011 and 2012 but are more spotty historically.)

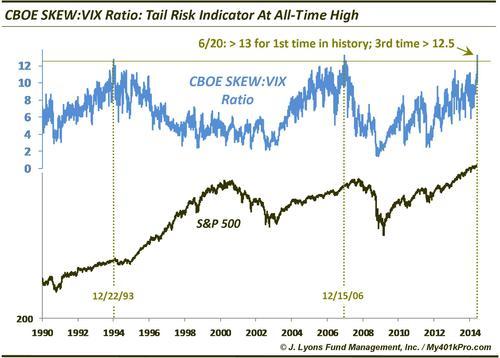

The main outlier reading in this outlier indicator came in October 1998. The SKEW reached its highest reading ever then – after a 20% “bear market” had already occurred. In an effort to weed out such SKEW spikes after a market decline had already taken place, we adjusted the SKEW by dividing it by the $VIX. That ratio yields our ChOTD:

As it turns out, the resultant SKEW:VIX ratio also hit an all-time – over 13 – on June 20. There were just two other times historically that the ratio approached that level:

- 12/23/93: The market topped 5 weeks later and went sideways for 12 months, losing 8% at its worst.

- 12/15/06: The market continued to rally for another 7 months before entering its cyclical topping formation, leading to the financial crisis meltdown.

What can we tell from 2 historical precedents? Well we can certainly say that this SKEW:VIX reading is a rare event. Besides that, any conclusion is probably speculation. One occurrence led to an almost immediate year-long, though very shallow, decline. After the other one, it took another 7 months before the market topped, but the result was a bonafide black swan event.

Our takeaway? The reading is probably a negative for the market, though perhaps not immediately. However, it is difficult to make a case for actionable value based on just two precedents.