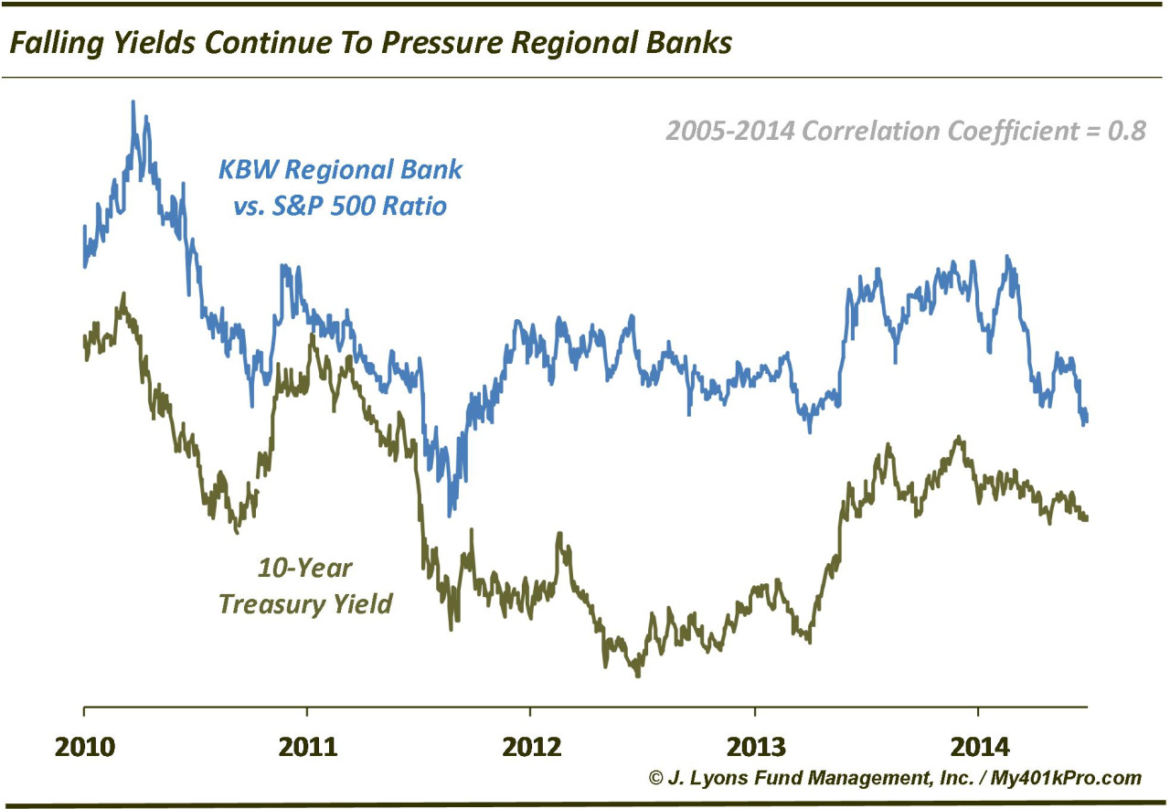

Falling Yields Continue To Pressure Regional Banks

There are so many cliches and platitudes on Wall Street regarding stock market behavior (“sell in May”, “never short a dull market”, etc.) that it’s hard to keep track of them all. And therein lies a problem. While advisors and pundits like to casually regurgitate these cliches, many of them are not tracked as to their accuracy or usefulness.

One such cliche that does pass statistical muster is that falling interest rates are negative for bank stocks. Naturally, falling long rates are negative, operationally, for banks as they put pressure on their net interest margin. However, it turns out that they do effect bank stocks’ performance as well, at least on a relative basis. Since 2005 (chart shows back to 2010), there is an 80% correlation between 10-year yields and the relative performance between regional banks and the S&P 500. Falling rates have hurt the KBW Regional Bank Index this year to the tune of -6.5% while the S&P 500 is up roughly that much.

Expect a continued drop in rates to further hinder regional banks, particularly given their vulnerable position, technically. In the short-term, while supported by the 61.8% Fibonacci Retracement of the May-July bounce, a potential bear flag exists in the KBW Regional Bank Index now under the 50 and 200-day simple moving averages. A break down below the flag (around 73.5) could see the index drop back to its May lows around 70 before finding some support.

Obviously a reversal in 10-year yields would be welcome news for these regional banks. Perhaps today’s GDP report will be the catalyst for such a reversal. We are focusing on the 2.49-50% level on the 10-Year as a pivot. Under there, and especially a break of 2.40%, could usher in a drop to the 2.20% area, and maybe 2.0% ultimately. A sustained hold above 2.50% is needed to support a reversal to the upside. A close above 2.65% is what we’d like to see to confirm any reversal up, however.

For now, the trend in rates is still lower, and that continues to bode poorly for regional banks.