ChOTD-7/1/14 Semiconductors Dominating Current Nasdaq 100 Run

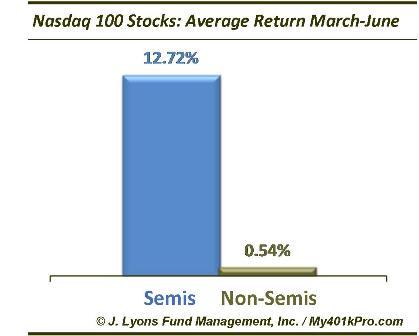

Today’s ChOTD(s) reveals how the Nasdaq 100’s nice run of late is due in overwhelming part to the phenomenal run by semiconductors. Since topping in early March and selling off into April, the $NDX has recovered to set new highs to end the 1st half of the year. Its return during that span (from the beginning of March to the end of June) was +4.15%. It has mostly the semiconductor stocks to thank for that gain, however. The average semi gained 12.72% during that period while the rest of the stocks in the Nasdaq 100 were barely up.

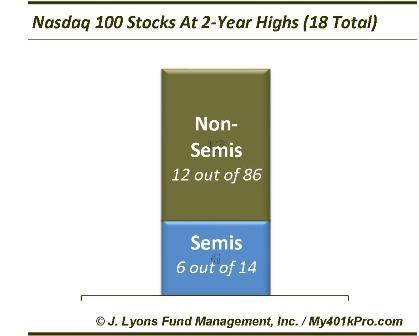

Furthermore, while the Nasdaq 100 is back at a new high, the new highs among its constituents is heavily weighted to semiconductor stocks, on a percentage basis. Of the 18 $NDX stocks at a 2-year high, 6 of them are semis, out of just 14 in the index. Meanwhile of the remaining 86 stocks, just 12 are at 2-year highs.

What is the takeaway, other than a trivial noting of the disproportionate influence of semiconductors on the recent Nasdaq 100 rally? Mostly, it just to emphasize the relative strength of semis. As we always stress, it is our philosophy that one attempt to identify, and stick with, relative strength areas when considering investment selection (we recognize this is not easy but it lessens the chance of the worst case scenario associated with value/mean-reversion strategies). Semiconductors still represent one of the relative strength areas in the market and, while “overbought” as many have pointed out, the sector rally has broad participation among its constituents, as indicated by the number of semis at new highs.

Another (less-forceful) takeaway is the underlying relative weakness in non-semi stocks in the Nasdaq 100, as indicated by the charts above. With fewer areas and stocks strongly participating in the rally, the strength in semis is masking that condition. Should the semiconductors begin to weaken, it could have negative implications on the Nasdaq 100 as a whole. Then again, the white knight of stock rotation may once again come to the rally’s rescue as a new leader takes over.