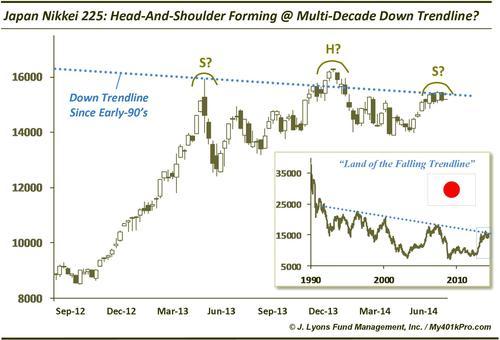

ChOTD-7/17/14 Japan Nikkei 225: Head-And-Shoulder Forming @ Multi-Decade Down Trendline?

Today’s ChOTD looks at the Land of the Rising Sun, a.k.a., the Land of the Falling Trendline. On April 1, we noted the Nikkei 225 appeared to be following its 2007 precedent whereby it suffered a failed attempted breakout of its post-1990 down trendline. Indeed, the Nikkei has failed to trade back above the trendline and is now forming a potential head-and-shoulder formation at the trendline.

While we rarely mention head-and-shoulders formations due to their subjectivity, complexity and inconsistency (we’d rather simply take note of lower highs), this development in the Nikkei is too potentially consequential to overlook. The fact that both (potential) shoulders on the chart (weekly) are occurring precisely on the trendline both raise the significance of the formation and validate the importance of the trendline.

Do we think this is a brick wall? Let’s say it is resistance until it isn’t, i.e., it breaks above. A break above, In fact, should it occur, is probably an even more intriguing scenario given the significance and duration of the trendline. Add to it the recent breakout in Japanese Small Caps and the (anecdotal) drop in attention, at best, and downright pessimism, at worst, toward Japanese equities and a breakout could be a consequential event.