ChOTD-7/21/14 PIIGS Relative Strength In Jeopardy; Breakdown could be red flag

Our last post on the economically-challenged peripheral European countries, better known as the PIIGS (Portugal, Ireland, Italy, Greece and Spain) was on May 15. At the time we noted that, contrary to the conventional weak-currency touting folks, it was a strong Euro that had been supporting the PIIGS during their post-2012 outperformance (supportive of peripheral bond issuance, confidence, etc.) We also took note that newly dovish talk out of Europe was beginning to undermine that outperformance as the PIIGS had suffered pullbacks of varying degrees. That weakness was temporarily interrupted by the ECB decision on June 5 to adopt a negative interest-rate policy on overnight bank depositers. As we mentioned at the time, the PIIGS reacted enthusiastically to that news and bounced strongly off of important support levels. This reaction, however, has been short-lived (not surprisingly since, again, a strong, not weak, Euro had been driving the rally in those markets). Selling in PIIGS markets (including Greece which we we warned about and Portugal which we mentioned) has picked up again in earnest and the post-2012 relative strength of the PIIGS countries is now in jeopardy. Why is this important?

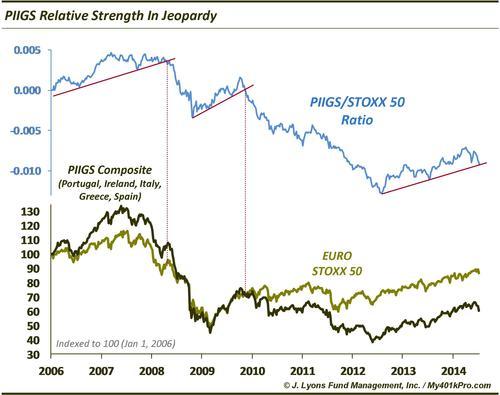

This chart displays the performance of the Europe STOXX 50 blue chip average vs. a composite that we developed made up of each of the PIIGS countries. The blue line indicates the ratio between the two. It is readily apparent that since 2006, stock market gains, in general, have occurred while the PIIGS were displaying relative outperformance. Conversely, the markets suffered after the uptrends in PIIGS outperfomance came to a halt. Currently, the PIIGS:Euro STOXX 50 ratio lies squarely on the uptrend line dating back to 2012. We would treat a break of that uptrend line as another example of the reigning in of risk that we are beginning to witness in the market (underperformance of small-caps, high-beta, biotech, high yield, etc.) And, at least based on the past 8 years, it would seem to be a warning for the broader market in general.

Most of the PIIGS are currently at key support levels on the charts. Therefore, a decent “bounce” would not be out of the question here. Indeed, until the uptrend line in the PIIGS:Euro STOXX 50 ratio is broken, it should be treated as support. However, should the up trendline break, we would steer well clear of the PIIGS for sure, and possibly the European market as a whole.