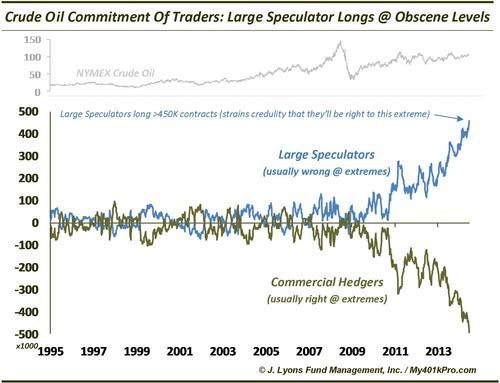

ChOTD-7/3/14 Crude Oil Commitment Of Traders: Large Speculator Net-Long To Obscene Extreme

We shift gears today away from the equity market (where it’s now become mundane to point out all-time records since every stock and metric is at an all-time high or low) to the futures market. Our ChOTD shows the Commitment Of Traders positioning in the NYMEX Light Sweet Crude Oil futures:

There are 3 main categories of traders monitored by the CFTC in the weekly COT report: Commercial Hedgers, Large Speculators and Small Speculators.

- Commercial Hedgers are typically involved directly in an industry reliant upon a particular commodity. Most of the time, they are truly “hedged” against the commodity and, since they are most intimately familiar with the commodity, are considered the “smart money”, at least when the market hits an extreme

- Large Speculators are by and large commodity pools that exist mainly to trade the market long and short (though long-only funds are perhaps included here, causing some distortion) These funds are normally trend-following entities and while they can be on the correct side of a long trend, at extremes they are considered “dumb money” as they are typically “off-sides”

- Small Speculators are mostly individual traders and hedge funds. They usually are alligned with the Large Speculators.

As the chart shows, Large Speculators’ net long position has risen over the past few years in an almost parabolic fashion to a level far above anything the market has ever seen. Conversely, Commercial Hedgers are a mirror image to them on the short side.

Is this extreme positioning a sign that oil prices are about to nosedive? We’re not so sure. Oil prices, while at the upper end of the range of the past few years, have not experienced a rise anywhere commensurate with the rise in Large Specs’ long positioning. Therefore, perhaps there is a structural change in the data that we are not aware of. We do know that long-only commodity funds and ETF’s may be distorting the COT figures a bit (other than that, we will defer to our friends at @AttainCapital, experts in all things futures, to parse it out). Regardless, on a short-term momentum and rate-of-change basis, the data still appears relevant. And based on those metrics, Large Spec positions are elevated to an extreme.

The one catch regarding the structural change argument is that we don’t observe the same behavior in other futures’ COT data. If, for example, long-only funds were distorting the net-long positioning of Large Speculators, we would expect to see the same types of extreme COT readings across other futures contracts that we see in Crude. That is not the case. Therefore, it is possible that Large Specs, aside from some structural change, really are extremely off-sides to the long side of crude. That would be a foreboding sign for the price of oil. While it is close to breaking out above 3-year highs, we would be on the lookout for a failed breakout if a new high does materialize. Given their historical track record at extremes, Large Speculators are not likely to be big beneficiaries in the long-run from an impending rise in crude prices.