Country Spotlight: It’s now or never for Russian stocks

It goes without saying there have been significant developments in Russian stocks since our last update on July 11. These developments have placed the Russian RTS Index at a potential make-or-break level. To review our posts on the Russian stock market:

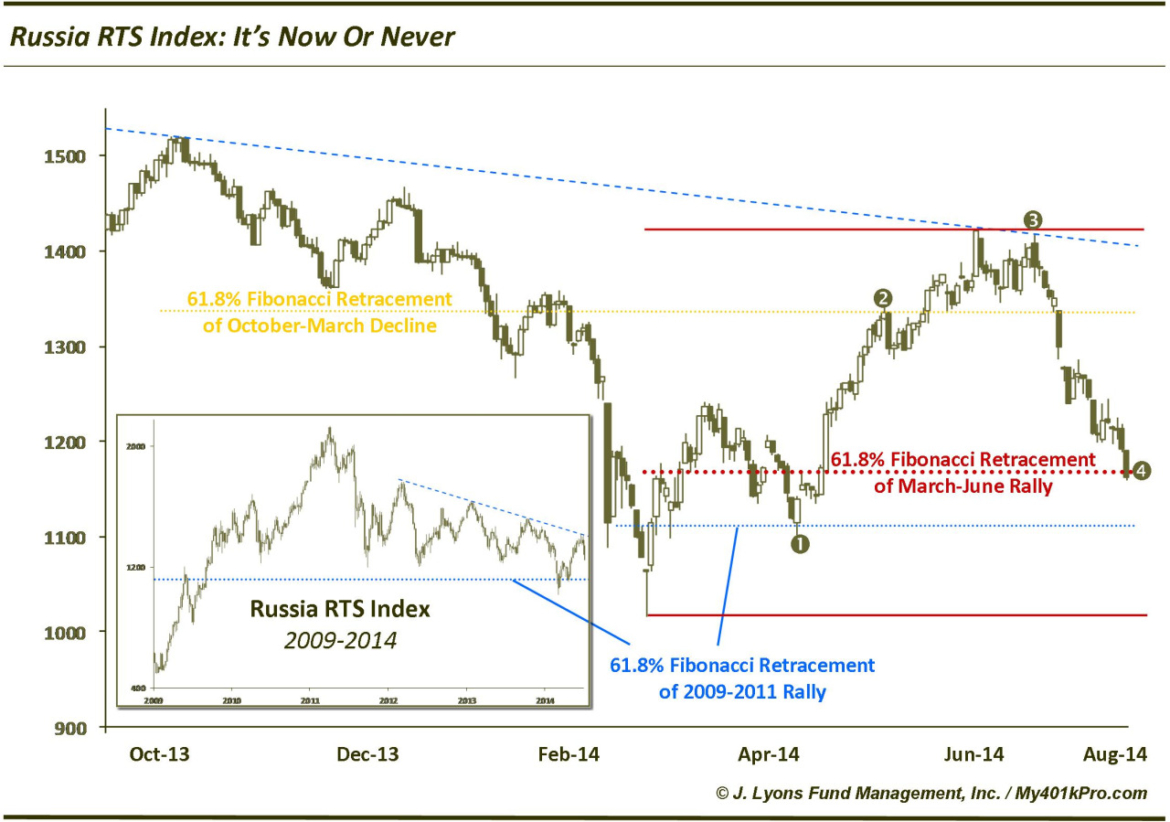

On March 4, we pointed out that the then-collapsing Russian stock market closed at the key 61.8% Fibonacci Retracement level of its 2009-2011 rally (number “1” on the chart). The “golden Fibonacci” level is the most impactful level and often creates the impetus for a turn. Indeed the market did arrest its 3-year decline there and began a bottoming process.

On May 13, we noted the progression of the bottoming process with the short-term potential target at the 61.8% Fibonacci Retracement level of the October-March decline (number “2”).

In the July 11 post, we noted that the RTS Index had surpassed the short-term resistance at #2 and was at the potentially longer-term directional determinant at the 2012-14 down trendline (number “3”). If the index was able overcome the trendline, it was likely that the Russian stock market was entering a longer-term uptrend.

Fast forward to the present and we see that the RTS obviously failed the test at the trendline #3. Whether it was the newly implemented sanctions or perhaps because the White House press secretary’s Russian stock shorts had finally been squeezed out, the RTS has sold off sharply in the past few weeks. It is now at a critical juncture: the 61.8% Fibonacci Retracement level of the March-June rally. The fact that it has retraced that much of its rally is not unusual nor does it invalidate the “bottoming” theory. Major turns retrace to the 61.8% frequently before they return to their previous bounce action – often turning a short-term bounce into a longer-term turn. It serves to shake out the money that’s uncommitted to the long-term bottom thesis.

Will the once-again hated Russian stock market reengage and execute a longer-term turn. Or was the bounce earlier this year just that – a bounce. That determination should be made based on the RTS’ reaction from current prices.