Divergence in discretionary vs. staples stocks a red flag

After a brief pause on Friday for Mr. Putin’s VIX day-trade, another V-bottom continues apace in U.S. large cap stocks following the devastating 4% decline. While this has become the norm for the past 20 months, one development pertaining to sector leadership is signalling a possible red flag.

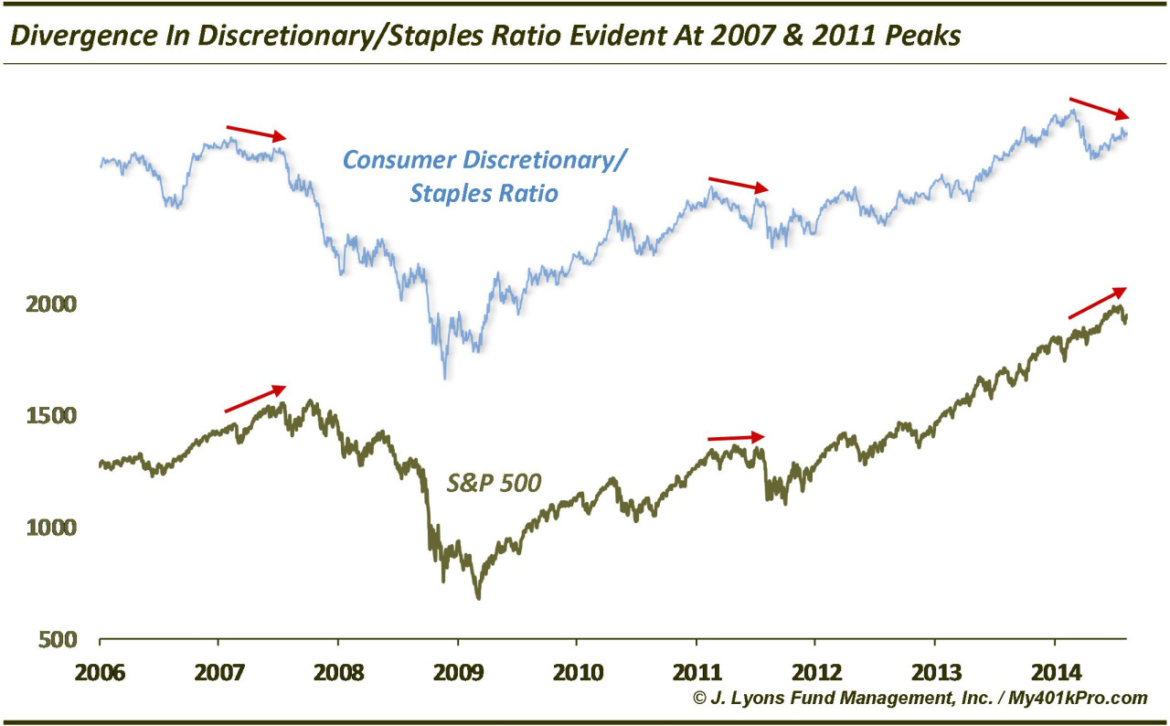

Though the S&P 500 looks poised to challenge its all-time high, the relative ratio between consumer discretionary and consumer staples stocks is well below its peak. In fact, it has not made a new high since early March. While specific sector leadership is not essential for the perpetuation of a rally, and indeed rotational strength has been a hallmark of the post-2012 up move, certain sectors have historically been emblematic of “healthier” rallies. These include cyclical sectors like consumer discretionary stocks. When more defensive sectors like consumer staples are leading, the robustness of a rally is more suspect, theoretically.

While these theories have shown mixed results, the discretionary vs. staples dynamic has been accurate over the past couple tops of consequence. In both 2007 and 2011, the ratio between discretionary and staples stocks (specifically, XLY and XLP) peaked approximately 5 months before the market began to drop. The 2007 top led to a cyclical bear market, of course, and 2011 saw an approximate 20% decline. The concern presently is that the discretionary to staples ratio topped in early March and has shown lower highs since, i.e., a divergence.

Whether or not the end result will be the same as the past two times this divergence occurred is impossible to know. However, all things equal, considering how those divergences turned out, we’d prefer that it wasn’t the case now.