High yield bonds: the bear battle begins

Perhaps no other market symbolizes this unprecedented central bank induced yield-reach era more than the high yield bond market. Investors’ search for income instruments that pay them more than 0% (or worse, take their money) has spurred record activity in the market affectionately known as “junk”. This includes both supply (corporate high yield issuance reached a record high in the 2nd quarter) and demand (high yield rates reached an all-time low below 5% in June). It is therefore no secret that the market is characterized by massive excess. We have no doubt that ultimately high yield bonds will be a poster child for this period of historic (experimental) froth…once it goes bad.

The problem with capitalizing on a potential blow up in the high yield market is that everyone knows it is frothy and that it will end badly, i.e., if everyone is aware of the potential risk, it would seem unlikely that such risk will materialize. That’s why trends tend to last longer than one would think. As long as not everyone is on board, there is more potential fuel to extend the trend. Once everyone is on board, there is nobody left to bid the market up. In this case, perhaps the psychological tipping point will come when the whole world is convinced that rates will stay at zero forever, thus buoying all yield-driven instruments.

We have one problem with the “high yield market can’t implode if everyone is on guard for it” argument: money. The amount of real money in the market is huge, as evidenced by the record supply, and is testament to the possibility that the potential risk could materialize. Any time that many investors are exposed to that level of potential loss, the risk is real. Just witness the sharp selloffs in June 2013 and last month. While there is a lot of money chasing the yields, a lot of investors appear to have one foot out the door should the market begin to turn lower. Record outflows from high yield bond funds last month is evidence of that.

So when does one make the stand as a high yield bond bear? Certainly the record low yields in June would have been a good spot. For us, just as we don’t like catching a falling knife, we don’t like to short all-time highs either. We prefer to see some weakness first off of the all-time highs. That then gives us a logical stop-loss point should the market overtake the high. Last month certainly provided weakness that we need to see to get us interested, a little too much weakness in fact. The record outflows were indicative of sentiment turning too sour, at least on a short-term basis. The solid bounce off of the lows confirmed that. Interestingly, the most recent data shows that investors have actually reversed course already and put money back into high yield bonds. Such a swift reversal from record outflows to inflows is unusual and demonstrates that sentiment on a longer-term basis is still quite bullish. Therefore, on a contrarian basis, risk is still ripe.

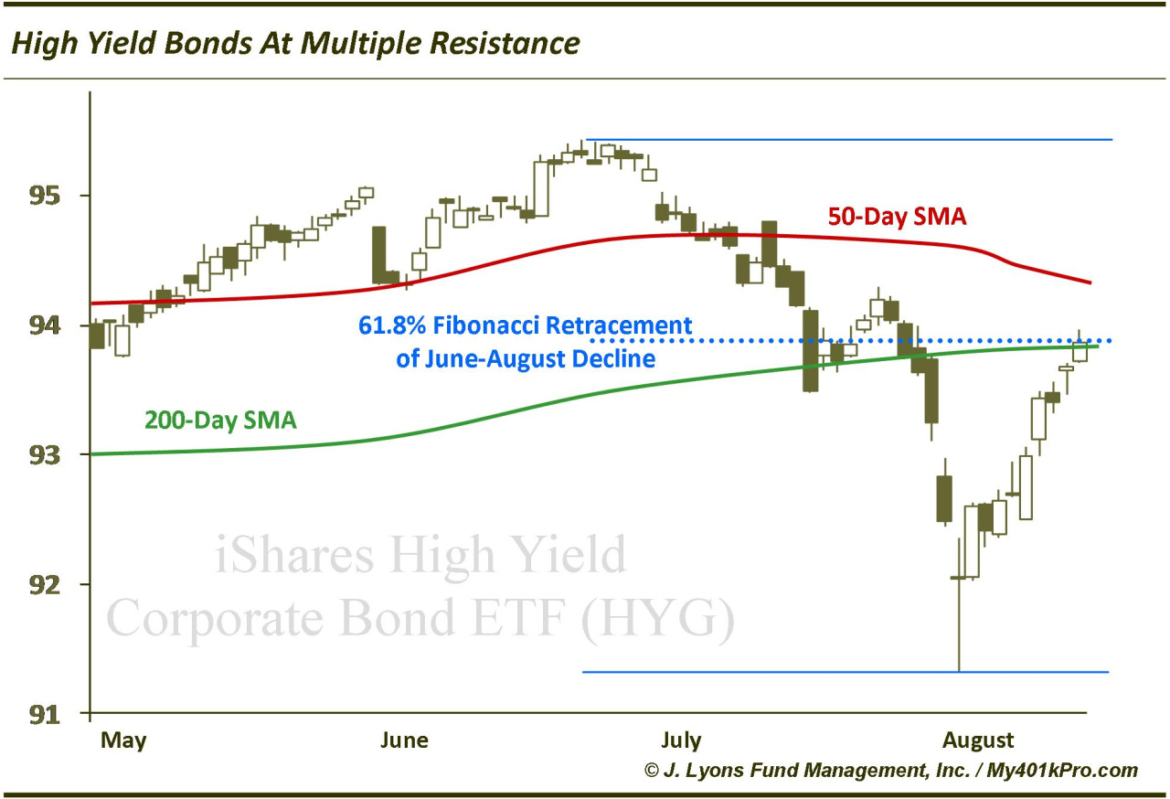

So the potential risk is still there, and we now have a potential lower high forming. As technicians, now we look for an area on the chart that would signal an attractive spot to start betting against the high yield bond market. For us, that point is now. Using the iShares High Yield Bond ETF as a proxy, there are several significant areas of resistance in the vicinity of current prices, including:

- The 61.8% Fibonacci Retracement of the June to August decline

- The 50-Day Simple Moving Average

- The 200-Day Simple Moving Average

That is solid enough ammo for us to begin our battle against the frothy high yield bond market.