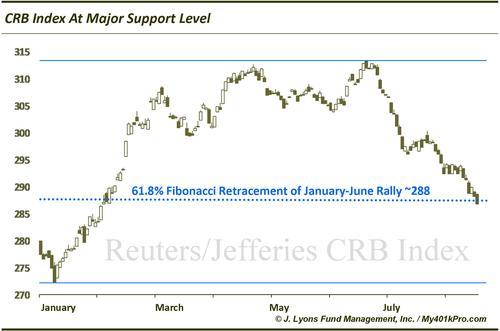

Commodity Spotlight: Besieged CRB Index At Key Level

After a strong performance in the 1st half of the year, the Reuters-Jefferies CRB Index has been under significant pressure lately. It is down 8% in just the past 2 months and has now retraced 61.8% of its January to June rally. Of course that is a key Fibonacci Retracement number and should provide at least temporary support for the index.

If it is unable to hold here, the entire first half gain looks to be in potential jeopardy. One factor in favor of it holding is that the CRB Index has respected Fibonacci levels in recent years. What we mean by that is various key Fibonacci levels that should serve as support or resistance levels were in fact successful. For example, after essentially crashing from 2008 to 2009, the subsequent rally was halted in 2011 precisely at the 61.8% retracement of the 2008-09 decline. Furthermore, the sell off into 2012 held right at the 61.8% retracement level of the 2009-11 rally.

Therefore, there is good reason to believe that the CRB Index will at least make an effort to hold near current levels. If it fails to do so, it runs the risk of losing another 6% or so until it reaches possible support near the lows of 2012-2014.