The tightest 3 day range on the NASDAQ 100 in history

The current low-volatility environment has been so epic that posts on low volatility have just become mundane. That said, every once in a while we come across a development that is too, well – epic, not to post. Thus it is with today’s Chart Of The Day. The past 3 days have seen the tightest range of all-time in the Nasdaq 100. And as they say, all-time is a long time.

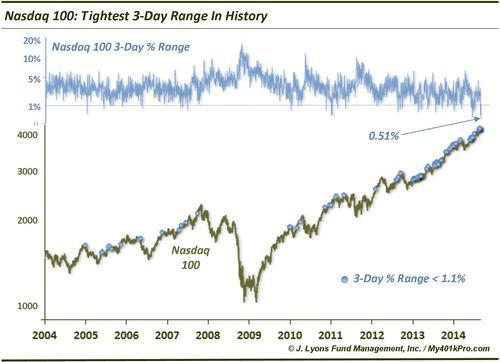

The entire range of the past 3 days in the Nasdaq 100 spans barely a half of one percent (0.51%). To understand how truly extraordinary that is requires a historical look at the NDX. And as we noted in our June 24 post which spotlighted the tightest 2-day range ever in the NDX (0.35% on June 22-23, which still stands), we really need to separate this post-2012 low-volatility environment from the rest of history to appreciate the uniqueness of this event and the current period. Here are the stats:

- From 1990 through 2012, the NDX 3-day range was less than 1% a total of 30 times, or 0.5% of all days.

- From the beginning of 2013 through yesterday, the NDX 3-day range was less than 1% on a total of 38 days, or 9.1% of all days.

- From May 1996 to November 2004, the NDX 3-day range was never less than 1%.

While we don’t need to see them to know that the current environment is unique, these statistics make the point crystal clear. After averaging a little over one such tight 3-day range per year for 22 years, we have averaged almost 1 every 2 weeks since the start of 2013. And when you consider that these are 3-day ranges, basically one out of every 4 days or so has been encompassed by one of these tight ranges.

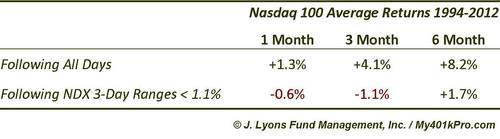

What is the point? Well, as we noted in that June 23 post, prior to 2013, these tight ranges were actually a fairly decent harbinger of intermediate-term weakness. Between 1994 and 2012, here are the forward returns in the Nasdaq 100 following 3-day ranges of less than 1.1%.

Needless to say, this trend has ceased to exist the past 2 years – like nearly every other historical tendency. For now, it’s still all about “buy the dip” – or even “buy the zip”, as in no volatility at all.