UPDATE: Russia Short-Term Bounce Done, Long-Term Bottom Still Possible

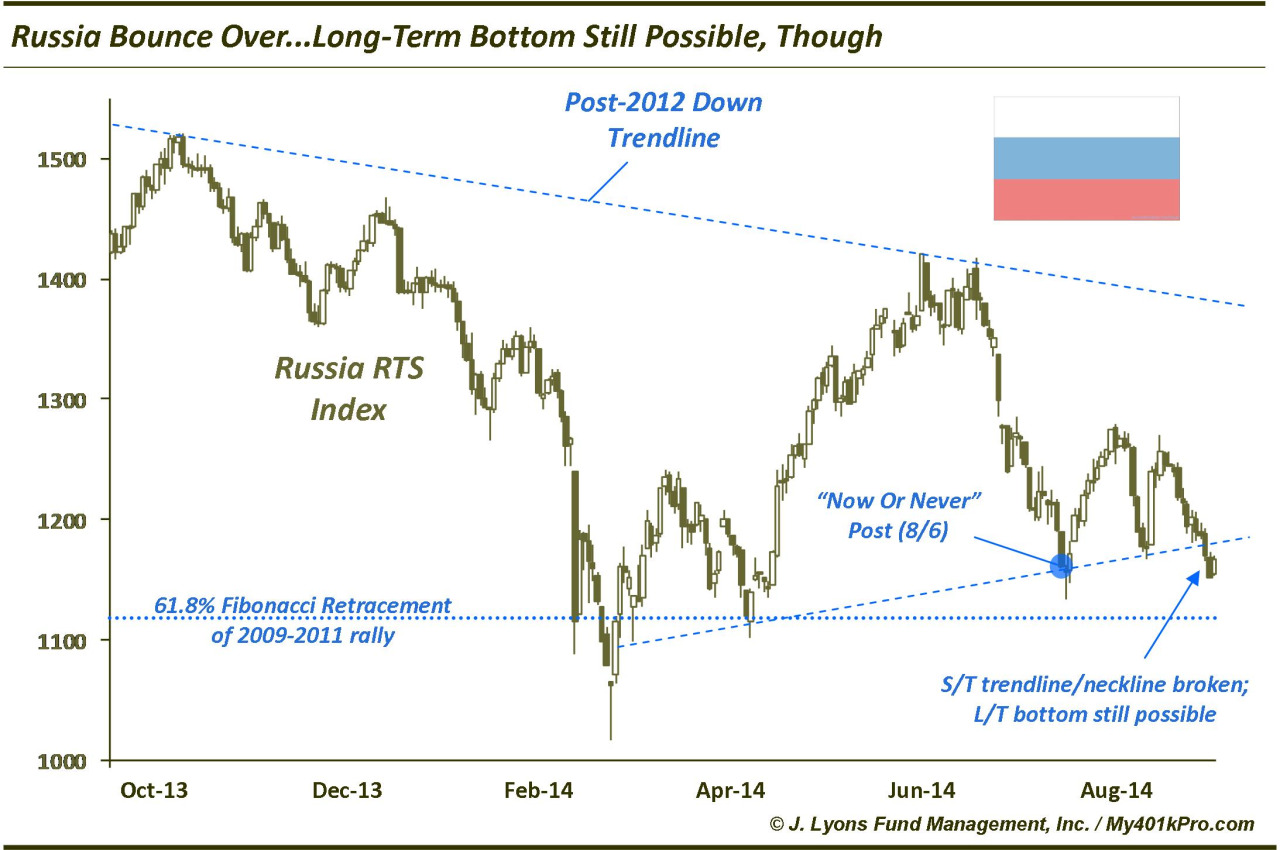

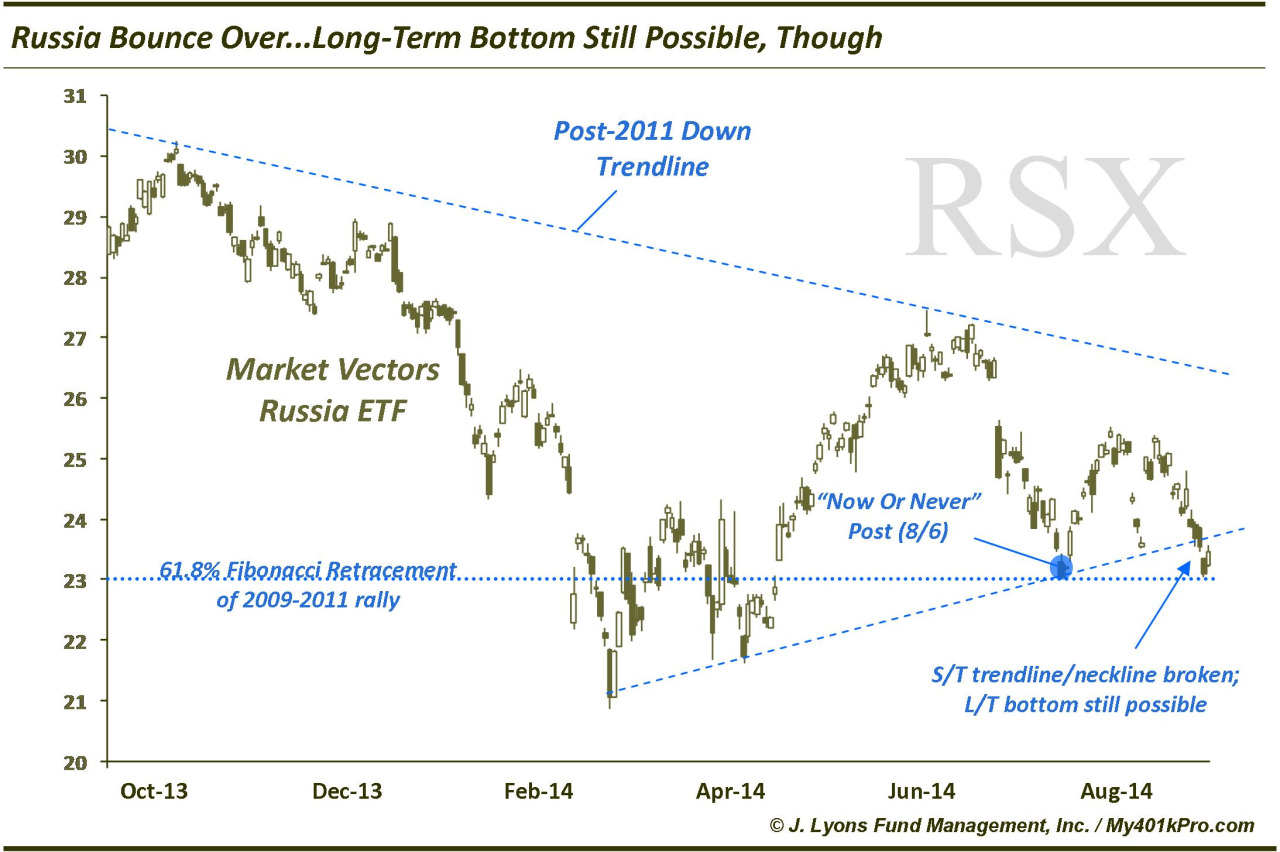

Starting on May 13, we have been opining about a probable short-term, and possible long-term, bottom in Russian stocks. The main catalyst was the positive action off of the 61.8% Fibonacci Retracement supoort line from the 2009 to 2011 rally. The Russian RTS Index bounced then tested that level, as did the Market Vectors ETF, RSX.

The short-term bounce did transpire as the RTS rallied close to 30% off the key Fibonacci level. A long-term potential turn, however, was stifled by the downtrend line stemming from 2012 (and from 2011 on the RSX). Subsequently, and concurrently with the second round of U.S.-led sanctions, Russian stocks dropped hard in July and into August.

On August 6, we published a post saying it’s “Now Or Never” for Russian stocks. The RTS had traded all the way back to the 61.8% Fibonacci Retracement of the rally from March to June. We felt it was the last gasp for the Russian market if it wanted to maintain any momentum from its initial bottoming pattern. At a minimum, we felt pessimism had become extreme and at least a short-term bounce may be in order. The RTS (and RSX) responded immediately, rallying some 12%.

Alas, it has proven to be merely a bounce as Russian stocks formed a lower high and proceeded to drop again. The result was a potential head-and-shoulder pattern. In the past 2 days, the RTS and RSX have broken their uptrend lines from the March low, confirming the end of the recent bounce. Additionally, the trendline would also signify the neckline of the head-and-shoulder pattern, which has significantly negative connotations.

We’re not so sure that the h-&-s pattern is valid. Considering the major 61.8% Fibonacci Retracement line from the 2009-2011 rally remains in place, a long-term bottom is still possible (though it is not as attractive a scenario as it was this spring). If that level is able to hold, it could form a double-bottom with the March low, providing a springboard for a longer-term turn.

For now, we would step away, content that the 12% bounce off the August 6 post is likely all we’ll get out of Russian stocks following the trend break. We will continue to monitor the action should the RTS or RSX probe the major Fibonacci line again.

_________

More from Dana Lyons, JLFMI and My401kPro.