Social Media Bubble Fails To Reinflate

We have discussed several times the tendency for sectors representing the bubble du jour – or at least the froth du jour – to top out (pop) ahead of the market, thus serving as a warning shot. Such froth is a result of over-crowding by investors as they chase the hot sector of the day. This behavior can be seen by following the level of margin debt, the behavior of which suggests much of the debt goes toward the bubbly sectors.

In a May 22 post, we pointed out how margin debt has historically topped simultaneously with the hot sector or bubble of the day. In the past few cycles, whether it was internet stocks in 2000 or financials in 2007, the bubbly sectors also peaked several months ahead of the major market averages. In the current cycle, margin debt peaked in February. We identified biotechs and social media stocks as likely “bubble” sectors that had popped in February-March, along with margin debt.

Since then, margin debt has made a bit of a comeback and is within spitting distance of its February high (as of July). Whether or not it makes a new high remains to be seen. If it does, it might largely be attributed to the biotech sector which has reinflated, surpassing its prior highs (much to our surprise). Social media stocks, however, are another story.

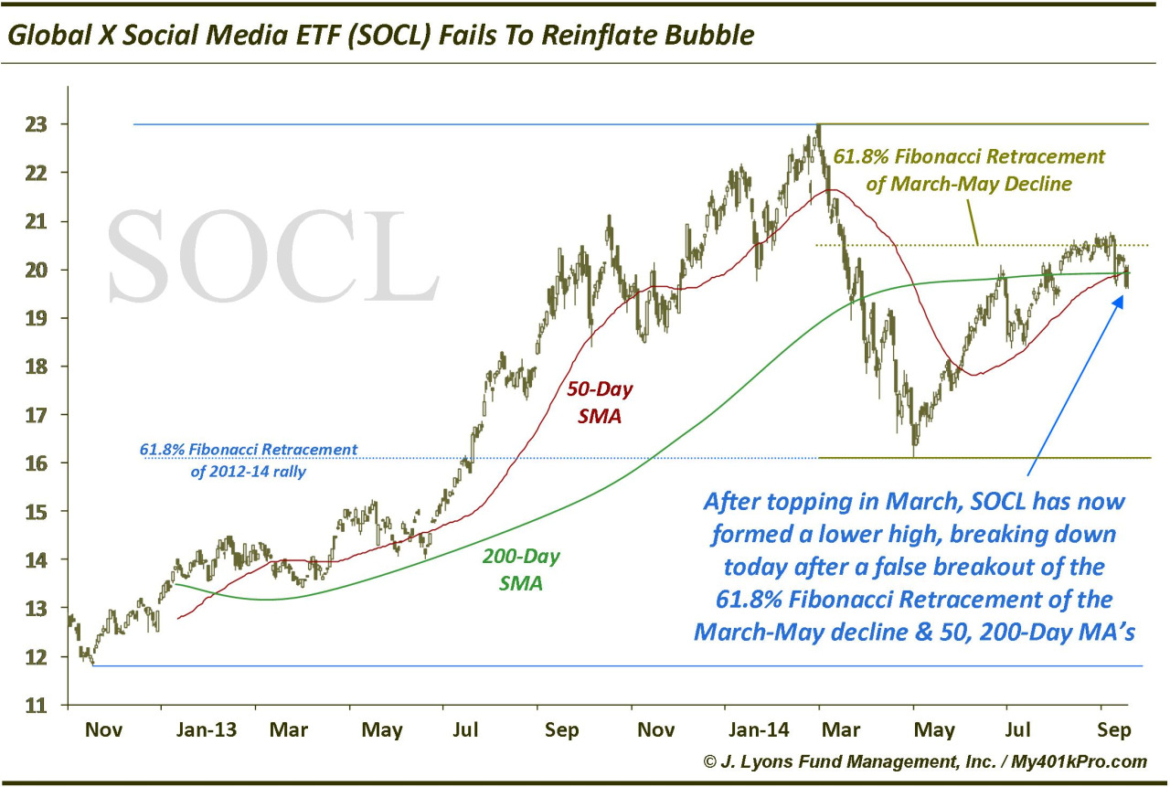

As judged by the Global X Social Media ETF (SOCL), social media stocks have not only been unable to approach their March highs, but they also are now failing in their attempt to do so. After dropping 30% from March to May, the ETF found support precisely at the key 61.8% Fibonacci Retracement of the 2012 to 2014 rally. (When a security does this, it gives us confidence that it is “respecting” the analysis, i.e., it is valid.) During September, SOCL has attempted to break above key resistance levels marked by the 61.8% Fibonacci Retracement of the March-May decline as well as the 50 and 200-day simple moving averages. As of today, SOCL is dropping below each of those levels as it is losing almost 3% and hitting 6-week lows. This not only confirms the false breakout, it also puts in place a lower high on the chart.

Most importantly, it casts major doubt on the likelihood that the bubble in social media stocks can be reinflated.

_________

More from Dana Lyons, JLFMI and My401kPro.