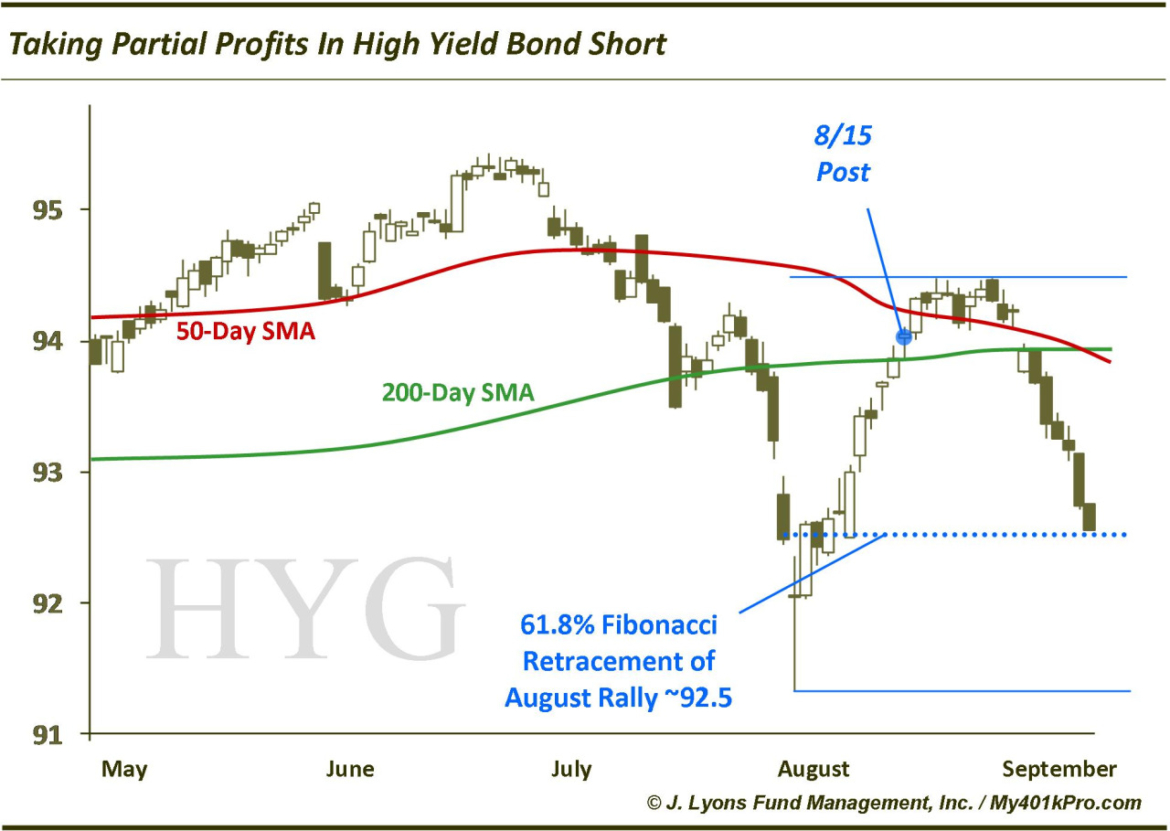

UPDATE: Taking Partial Profits In High Yield Short

On August 15, we outlined our longer-term bearish case toward high yield bonds as well as a shorter-term chart-based rationale for an entry point for a short. Today, we see ample evidence for taking partial profits on that short position…for now.

We are still just as negative long-term on the high yield space. However, trying to time a short in a manic-driven asset is a perilous endeavor. Therefore, though this bear battle will likely be a long-term affair, for now, attempting to be somewhat surgical with shorting attempts may be the sensible strategy.

If high yield bonds are indeed topping, it will probably be a drawn-out process filled with ups and downs. Eventually, a “waterfall” type collapse is possible and holding a partial position still is advisable for that possibility. However, we don’t suspect that moment is here yet. Therefore we don’t think it is yet time for a “short-and-hold” strategy.

The current move down looks quite possibly to be a retest of the August 1 low. If that is the case, the 92.5 level on the iShares High Yield Bond ETF (HYG) marks the 61.8% Fibonacci Retracement of the August rally. That would be a logical place for HYG to bounce – unless of course it is not the beginning of the waterfall.

We would likely see fit to add this short piece back at higher prices.