Broker/Dealers Break Out; More Upside Ahead

Perhaps no market in recent memory has been so characterized by the theme of “rotational leadership” as the post-2013 rally. Countless sectors and industries have taken turns stepping up to lead this market. Thus, for all the red flags and warts on this market, the continuous emergence of new leaders has helped maintained that persistent bid under the market.

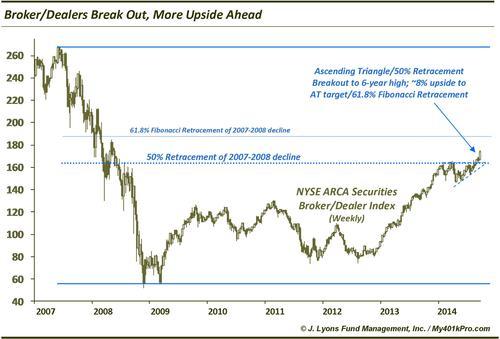

One of the most recent sectors to step forth and grab the leadership mantle, speaking of warts, has been the broker/dealers. Despite the cyclical (or secular) decline in equity volume and the concern over the lack of bond supply, the stocks of broker/dealers have been exceptionally strong of late. Last Friday, as the S&P 500 closed down 0.6%, the NYSE ARCA Broker/Dealer Index (XBD) was up 0.6%. For the week, the XBD was up over 4%, breaking out to a 6-year high in the process.

The XBD breakout level corresponded with highs in January, March and July of this year, as well as the 50% retracement of the 2007 to 2008 decline, adding significance to the breakout. The higher lows since April arguably make up the lower bound of an ascending triangle. As long as the XBD holds the general breakout level around 165, the breakout of the ascending triangle would imply an upside target of roughly 8% to about 186. This level would also correspond with the 61.8% Fibonacci Retracement of the 2007-2008 decline.

One caveat exists that we would be remiss not to bring up, however: the pace of the leadership rotation. Whereas historically, leadership has tended to rotate on the order of quarters and years, the current market seemingly has new leaders every month. This has actually presented a challenge for trend-following hedge funds and portfolio managers. They have consistently been zigging while the market is zagging.

That is, they have been buying strong areas that, in the past, would have continued to display relative strength for some time. However, due to the faster than usual rate of turnover, these strong areas have quickly and repeatedly reverted to weakness in short order. Conversely, attempts at selling/shorting weak areas have recently been met with abrupt v-bottoms and bounces straight back to previous highs. This has been the era of false breakouts/breakdowns.

Therefore, it is possible that this move will turn out to be another failed breakout. However, the setup, historically, is a sound one that presents a better than 2:1 reward to risk ratio that the broker/dealers still have something left in the tank.

_______

More from Dana Lyons, JLFMI and My401kPro.

“NYSE” photo by James Scott.