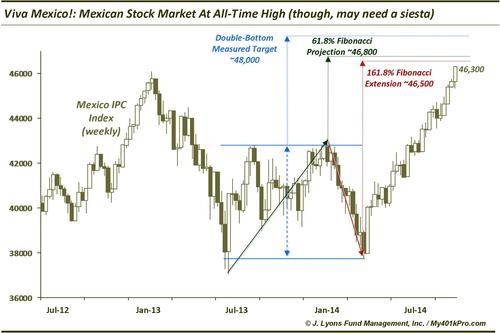

Viva Mexico! Mexican Stocks Breaking Out To All-Time High

With much of the investment world intently scrutinizing each tick in the S&P 500 and parsing each syllable uttered by an American and European central banker, much of the stock market action in the rest of the world flies under the radar. There is actually a lot of good stuff going on, from potential major bottoms/turns (Emerging Markets, Latin America, etc.) to new 52-week highs (Australia, Hong Kong, China, Asian EM, etc.) to potential all-time highs (India, Canada, UK, etc.) As of yesterday, you can add Mexico to that last category.

Our last post about the Mexican IPC Index came on Cinco de Mayo (May 5). Consider this an update. In that post, we noted the bull flag developing at the time at the 61.8% Fibonacci Retracement of the December to March sell off. We suggested it was likely to break out above that level and test the 61.8% Fibonacci Retracement of the January-June 2013 decline (around 42,700) which had repelled the market on 2 occasions, in August and December of last year. We didn’t have to wait long for that breakout as it happened the very next day. Within a week, the IPC had already rallied some 5% up near the key 42,700 mark.

After initially being rejected by that level in May and again in June, the IPC broke out above it and has not looked back. In fact, it is now up 7 months in a row without as much as a 3% pullback. And, as mentioned, yesterday it broke above the previous all-time high set at the January 2013 high.

The breakout of the 61.8% Fibonacci Retracement of the 2013 decline and now subsequent rally to new highs is actually pretty significant, in the big-picture. Since arguably commencing a secular bull market in 2003, the Mexican stock market has steadily made higher highs and lows. The high of last December looked to be a potential lower high setting up a possible cyclical bear market upon a break of the June 2013 lows. However, the higher low in March combined with the break above the 61.8 level and now new highs confirms the persistance of the secular bull.

That said, all is not bueno for this market – at least in the short-term. Considering its recent run, the market may be in need of a siesta before another leg up begins in earnest. At the very least, some consolidation would would set up a more attractive entry point. Why do we say this?

For one, the market is up 7 months in a row. Momentum can certainly drive it a bit higher in the near-term but, historically, it has not gone much further after reaching such a streak. To put it another way, it is overbought, as its weekly reading on the Relative Strength Index of 74 would attest. Furthermore, the best, most sustainable breakouts are those that consolidate at the previous highs before breaking out. This can allow the market to work off the overbought condition as well as rid it of traders’ profit-taking spurred by the move to the previous high level. After such action, the market will have more “energy” to make a sustainable run to new highs.

Lastly, from price projection analysis, several indications point to a rest in this area. These stem from the bottoming action between June 2013 and March 2014.

The projection analysis and resulting targets include:

-

Double-Bottom (June 2013 & March 2014) Measured Target = roughly 48,000

-

61.8% Fibonacci Projection of June-December rally = roughly 46,800

-

161.8% Fibonacci Extension of December-March decline = roughly 46,500

What is the takeaway? The Mexican stock market has broken out to all-time highs. There is nothing more bullish than that. It also confirms the secular bull market is still intact. However, it is overbought in the near-term. Some consolidation nearby is likely, based on projected targets. This consolidation could provide for an attractive entry point and a springboard to the next leg up in the Mexican bull market.

_______

More from Dana Lyons, JLFMI and My401kPro.

Mexico Flag photo by Rodrigo Reyes Sànchez.