Another Tragedy Unfolding In Greek Stocks

Yesterday, we published a post titled “The PIIGS Are Starting To Squeal Again”, noting the deterioration in the peripheral European stock markets. Of the PIIGS, none look sicker than Greece – even sicker than Portugal if only for the fact that it has already crashed.

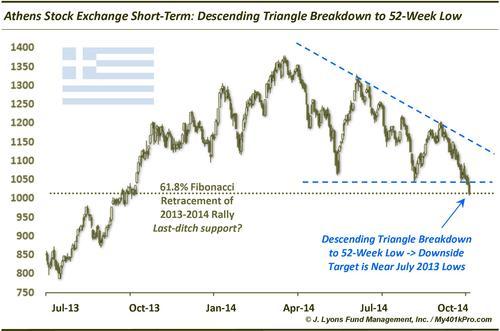

Back on May 14, we indicated that while the Greek Athens Stock Exchange index was sitting on short-term support and due for a “bounce”, longer-term indications were that it was set up for another Greek tragedy. Sure enough, after a 3-day scare, the stock market jumped some 20% into the June excitement surrounding the negative rates implemented by the ECB. Unfortunately, the second act is playing out as expected as well. That early June high was as far as the market would go and it’s now breaking down from a descending triangle to a new 52-week low.

The break of the triangle suggests an eventual target in the 700’s, near the July 2013 lows. Perhaps the index’s last hope for holding here is the 61.8% Fibonacci Retracement of the 2013-14 rally. Additionally, some might argue that the formation is actually a falling wedge which would imply an eventual breakout higher. However, we will see your wedge and raise you a complex head-and-shoulders.

To simplify, we’ll just note the series of lower highs and the breakdown to 52-week lows. The implications of that are clear. Enough said.

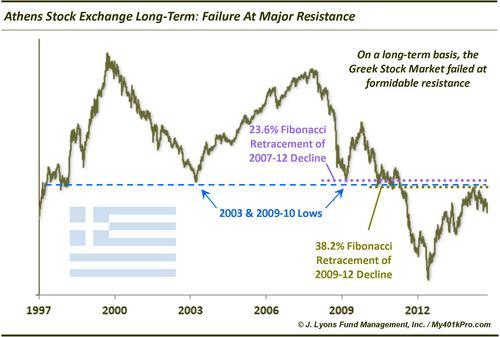

From a longer-term perspective, we see the challenges the Athens Stock Exchange faces, and some good reasons why the index failed where it did.

The June high came in the vicinity of the following key resistance levels:

- 23.6% Fibonacci Retracement of the 2007-12 decline

- 38.2% Fibonacci Retracement of the 2009-12 decline

- 2003 and 2009-10 lows (support becomes resistance)

Therefore, even if the index is able to overcome its short-term threats, or after those threats run their course, major long-term challenges promise to continue to bring more tragedy than triumph for Greek stocks.

________

More from Dana Lyons, JLFMI and My401kPro.