Rapid retreat in volatility bullish for stocks

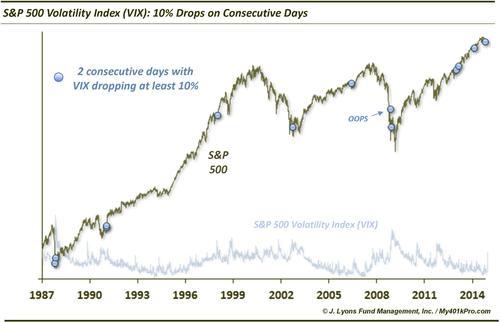

Just yesterday, we posted a chart showing that the S&P 500 Volatility Index (VIX) had recently spiked to a 6-year high relative to the Russell 2000 Volatility Index (RVX). How quickly things change in this market. This post looks at the rapid, and rare, pullback in the VIX the past few days, on an absolute basis. Specifically, the VIX has dropped more than 10% each of the past 2 days. Since 1986, this is just the 12th time this has happened.

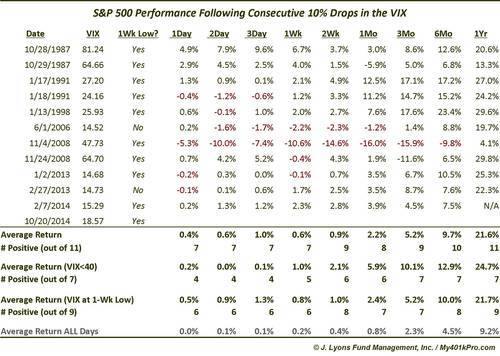

The performance of the S&P 500 following these large 2-day drops in the VIX has been extremely positive across all time frames. Here are the dates and returns.

As the table shows, the average returns are much greater than typical following these events. Additionally, returns were consistently positive.

There was really only one exception to the positive performance, though it was a big one. That occurred on November 4, 2008 in the depths of the financial crisis. One obvious difference between that period and today is the level of the VIX. In November 2008, the VIX was well above 40. As of yesterday, it is back below 20. Isolating those occurrences when the VIX was below 40 highlights those that are most similar to today’s conditions. Doing so weeds out the 1987 and 2008 occurrences. Returns going forward are even better than with the entire sample, and almost unanimously positive beginning at 2 weeks.

The only other occurrence that saw consistently negative returns for up to one month was June 1, 2006, although it did turn positive beyond that duration. One difference between the 2006 occurrence and today’s is that in 2006, the VIX did not even move to a 1-week low following the 2-day drop. Targeting just those occurrences when the VIX made a 1-week low, as it did yesterday, produces marginally better and more consistently positive returns.

Perhaps that is parsing the data too much anyway considering the sample size is already small enough. As a whole,taking these precedents at face value, the large 2-day drop in the VIX should be a bullish sign for stock investors.

________

More from Dana Lyons, JLFMI and My401kPro.