Record spike in Crude Volatility Index may bring a bounce in oil

With the recent carnage in global equity markets, the bludgeoning taking place in the crude oil market has flown somewhat under the radar, at least until the past few days. Things are getting serious now in the oil market as evidenced by yesterday’s largest drop in several years. The United States Oil Fund, USO, is on track for its largest weekly and monthly losses in several years as well. All told, the USO is down almost 25% in the last 4 months.

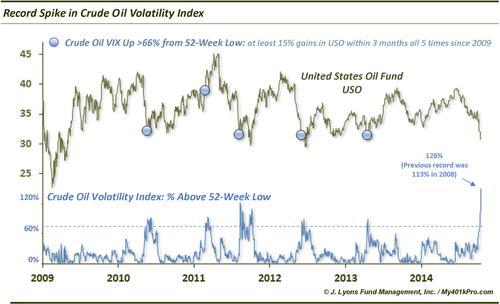

Traders are now starting to take notice of the damage. One manifestation of that can be found in the Crude Oil Volatility Index, OVX. Like equity volatility indexes, such as the VIX, the OVX indicates traders’ expectations for the level of volatility in the USO. While the OVX has been higher on an absolute basis before (2008 and 2011), on a relative basis, it is seeing a historic spike. As of yesterday, the OVX was a record 126% above its 52-week low.

As scary as the ongoing sell off in oil and concomitant rise in volatility may seem, we may be at a point representing a buying opportunity in the commodity, at least over the short to intermediate-term. That is if recent history is any indication. Since 2009, there were 5 instances in which the Crude Volatility Index jumped at least 67% off of its 52-week low. Each time, USO bounced over the following weeks and months. These were the results.

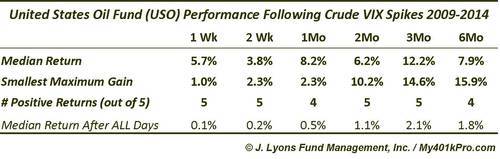

As the table shows, following each of these 5 occurrences, the USO was higher after 1 and 2 weeks and after 2 and 3 months – and substantially so. The smallest maximum gain among the 5 over the following 3 months was almost 15%. The 3-month point seemed to be the sweet spot from a median return perspective as the USO tended to drop after that. This is not surprising considering the fund has been in a sideways range over the entire period. That makes the positive results following the OVX spikes that much more impressive.

Obviously 5 occurrences is not a significant sample size so buying blindly without regard for risk management is not recommended. Additionally, considering the swiftness of the current decline and the fact that some key support levels have been broken, further short-term “waterfall” risk exists. It is also entirely possible that a new cyclical decline may be in force as opposed to the trading range that has persisted for the last 5 years.

However, for those that subscribe to the “buy fear” theory, your fear is here. If recent history is any guide, any further short-term weakness should eventually give way to a sizable, if temporary, intermediate-term bounce.

________

More from Dana Lyons, JLFMI and My401kPro.